Amid promising growth, companies in the insurance industry are being pressured to evolve their business models because of rising consumer expectations, new technologies and a widening skills gap in the workforce. These changes, in turn, threaten current workforce models and require changes in six jobs.

There’s economic promise in the insurance industry: A recent survey of property and casualty, life and health insurance companies found that 62% of respondents are planning to add staff in 2014. The U.S. insurance industry projects the addition of 200,000 employees between 2012 and 2022, and in March 2014 its unemployment rate (3.3%) was half of the national average (6.7%).

While the industry growth is a boon, insurers must overcome employment challenges before seeing its benefits. Attracting talented people is a particular stumbling block for insurers: Just 5% of students in the millennial generation are very interested in working in the insurance industry. As the insurance workforce continues to age — more than half of the current insurance workforce is over age 45 — insurance companies will have an ever-widening gap to fill.

Moreover, as with many other industries, the insurance industry is plagued by a skills gap that prompts industry representatives to cite difficulty filling open positions with qualified candidates. Graduates and entry-level workers lack the industry experience and knowledge of those who are retiring. Career insurance employees are often missing the technology skills and savvy that are increasingly required to handle new systems being adopted by insurance companies.

Incumbents are pressured to evolve or dissolve

Ezekiel Emmanuel — one of the architects of the Affordable Care Act — writes in his new book that “because of health care reform, new actors will force insurance companies to evolve or become extinct. The accountable care organizations (ACOs)…and hospital systems will begin competing directly in the [health care] exchanges and for exclusive contracts with employers." The healthcare exchanges are becoming a game changer for the way consumers purchase their coverage. Now providers will be competing on “the best quality, service and price.”

Robert Pearl, M.D. — a contributor to Forbes — contends that these healthcare exchanges “will create more transparency and make the coverage-selection experience resemble purchasing airline tickets on Expedia or Orbitz.” Consumers will be empowered with technology, information and choice in a process that traditionally has been out of their control.

This expectation of the “consumerization” of insurance is not limited to healthcare. A 2013 survey of more than 6,000 insurance customers in 11 countries reveals that they desire:

- More personalized services from their providers

- Reduced risk

- Engagement through continuing conversations

- Access to information via online, in-person, mobile and other channels

- Information that is consistent across all of those channels.

Customers will begin to flock to insurance companies that can provide the consumer-centric experience they’ve become accustomed to in other industries and businesses. A recent survey of 2,500 insurance customers by Accenture shows that more than 90% of respondents choose insurers based on:

- Speed at which their problems are resolved

- Availability of products and services that meet their specific needs

- Competitive pricing for products and services

- Transparency of prices and charges

- A high level of information about proposed products and services

- Knowledgeable and responsive phone support.

To attract and retain customers, insurers will need to move toward customer-centric models, which will require adoption of new technologies and employee skills.

Evolving business models spur changes in business systems and roles

Many larger insurance organizations have been relying on legacy computer systems that were built around regulatory requirements for paper-based documentation. With such regulations now lifted, insurers are free to modernize their systems and implement more automation, self-service features and access to real-time information to meet consumer expectations. They can also build into their insurance business systems new features that improve customer-centricity, such as:

- Robust customer relationship management tools with integrated communications channels — such as email, online chat and click-to-call voice

- Customer segmentation

- Big data and predictive analytics

With these technologies and customer expectations, today’s frontline and operational insurance workers need to be more tech-savvy and have better communication skills and better problem-solving capabilities. There will be significant effects on six key frontline and operational positions, which collectively made up more than 35% of the industry’s workforce in 2012.

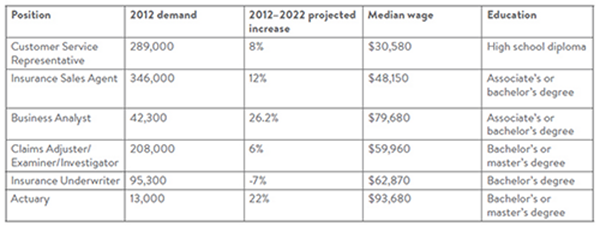

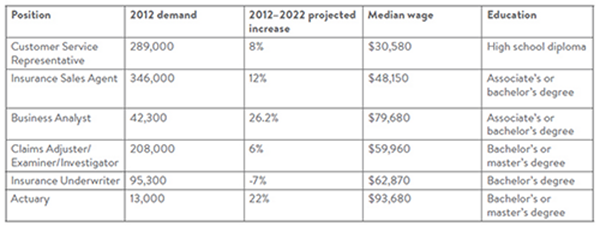

Table 1: Key frontline and operational positions in the insurance industry

Source: Bureau of Labor Statistics

Hiring and promoting in the new insurance landscape

These six key job roles span much of the career spectrum of the industry. For example, individuals who have not yet earned a post-secondary degree can perform well as customer service representatives and then continue their studies while on the job to advance their careers. Those with associate’s degrees may be able to begin as entry-level sales agents. As workers progress through their careers and gather additional education and experience, the insurance industry offers them myriad growth opportunities in sales, finance, human resources and technology.

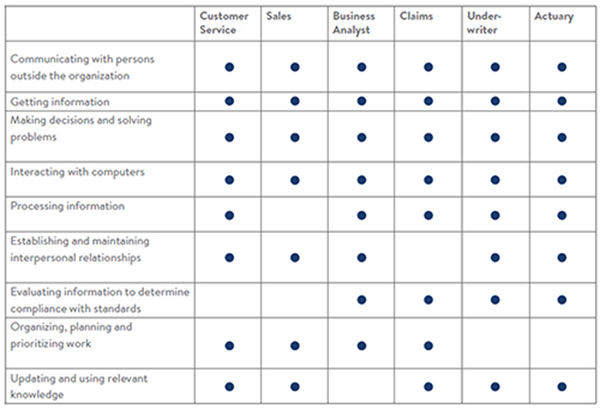

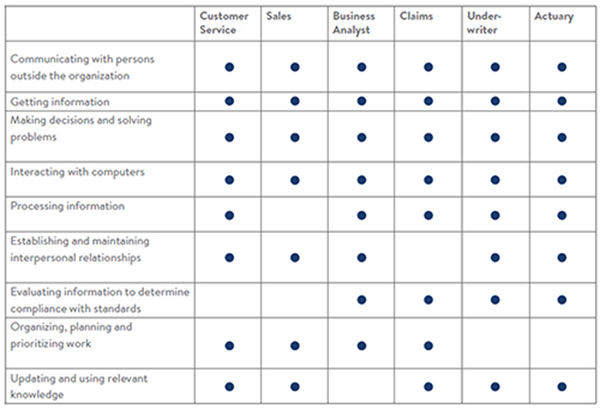

While these positions differ in required education, responsibilities and technological complexity, they share a number of skills or detailed work activities (DWAs) — an occupational classification system of the Federal Government O*NET system. DWAs describe business work tasks that can be found across multiple occupations and remain constant over time. We’ve been able to identify nine skills or DWAs that largely cut across the positions examined in this report:

Table 2: Cross-cutting skills

Source: O*NET. For full DWA descriptions, go to onetonline.org.

DWAs are logical units of analysis for hiring and promoting employees, as well as curriculum and training program development, because they transcend frequently changing industry staffing patterns and company–specific job descriptions.

A closer look at key frontline and operational positions

Below is a snapshot — including employee profiles, typical education and career paths, responsibilities and impacts of technology — for customer service representatives. These insights are the result of the research performed by the workforce strategies team at College for America — a nonprofit, accredited college dedicated to providing more accessible, workplace-applicable degree programs to working adults. Its findings reflect labor market data, real-time job listings and feedback from insurers nationwide.

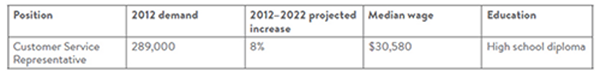

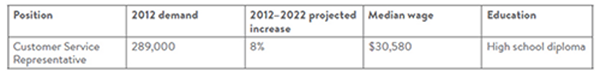

Snapshot: Customer service representative

Source: Bureau of Labor Statistics

Tony had worked throughout high school at a local retail store. After graduation, he wanted to enter a career path that would offer advancement and tuition reimbursement so he could pursue a college degree. With the people and listening skills he learned from working retail, he was offered a position as a customer service representative at a life insurance company.

Before working with clients at his new position, Tony participated in the company’s training program to learn about products and services, customer management, departmental responsibilities and where to find information. He also learned telephone techniques to better interact with clients.

As a customer service representative, Tony spends his day answering questions, providing information to clients and resolving complaints. He has become adept at dealing with conflict, as his clients often call under stressful circumstances. Tony is currently taking courses at a local college and hopes to make his way into a sales position in his company.

Education

Customer service representative positions require a minimum of a high school diploma, though often employers are seeking people with an associate’s or bachelor’s degree. Representatives generally receive company-specific training before beginning work.

These positions provide an opportunity for individuals to learn the insurance business, and they serve as a stepping stone to other insurance careers.

Responsibilities

A customer service representative may be expected to:

- Work with policyholders and clients to answer questions, respond to requests for information and handle and resolve complaints

- Play a critical role as the “face” of the insurance agency to clients

- Respond to client needs and provide information about products and services

- Take orders, determine charges and oversee billing and payment

- Ensure client information is complete and accurate

- Keep detailed records of customer interactions

- Notify customers of claim investigation results and planned adjustments

- Refer unresolved grievances to the appropriate department

- Review insurance policies to determine if a loss is covered

- Communicate with clients in-person via telephone, emails, and online chat

- Manage angry or unhappy clients

- Speak with clients who are dealing with stressful situations such as a car accident, illness of a loved one or a natural disaster.

Impact of technology

Customer service representatives are now engaging with customers in modalities other than on the phone, such as through email, online chat and social media. Soft skills in writing, communication and active listening are increasingly important as the connectedness of the Internet makes it easy to broadly share representative-to-client communications — whether good or bad.

Similarly, customer service representatives are being fed customer data from across the Internet and from within their business systems (known collectively as big data). These representatives must learn how to use the right information to inform interactions with customers and engage them in the selling cycle by providing information about products that would likely be of interest to them.

For the full report, including snapshots of the other five, key job types, click here.  Source: Bureau of Labor Statistics

Hiring and promoting in the new insurance landscape

These six key job roles span much of the career spectrum of the industry. For example, individuals who have not yet earned a post-secondary degree can perform well as customer service representatives and then continue their studies while on the job to advance their careers. Those with associate’s degrees may be able to begin as entry-level sales agents. As workers progress through their careers and gather additional education and experience, the insurance industry offers them myriad growth opportunities in sales, finance, human resources and technology.

While these positions differ in required education, responsibilities and technological complexity, they share a number of skills or detailed work activities (DWAs) — an occupational classification system of the Federal Government O*NET system. DWAs describe business work tasks that can be found across multiple occupations and remain constant over time. We’ve been able to identify nine skills or DWAs that largely cut across the positions examined in this report:

Table 2: Cross-cutting skills

Source: Bureau of Labor Statistics

Hiring and promoting in the new insurance landscape

These six key job roles span much of the career spectrum of the industry. For example, individuals who have not yet earned a post-secondary degree can perform well as customer service representatives and then continue their studies while on the job to advance their careers. Those with associate’s degrees may be able to begin as entry-level sales agents. As workers progress through their careers and gather additional education and experience, the insurance industry offers them myriad growth opportunities in sales, finance, human resources and technology.

While these positions differ in required education, responsibilities and technological complexity, they share a number of skills or detailed work activities (DWAs) — an occupational classification system of the Federal Government O*NET system. DWAs describe business work tasks that can be found across multiple occupations and remain constant over time. We’ve been able to identify nine skills or DWAs that largely cut across the positions examined in this report:

Table 2: Cross-cutting skills

Source: O*NET. For full DWA descriptions, go to onetonline.org.

DWAs are logical units of analysis for hiring and promoting employees, as well as curriculum and training program development, because they transcend frequently changing industry staffing patterns and company–specific job descriptions.

A closer look at key frontline and operational positions

Below is a snapshot — including employee profiles, typical education and career paths, responsibilities and impacts of technology — for customer service representatives. These insights are the result of the research performed by the workforce strategies team at College for America — a nonprofit, accredited college dedicated to providing more accessible, workplace-applicable degree programs to working adults. Its findings reflect labor market data, real-time job listings and feedback from insurers nationwide.

Snapshot: Customer service representative

Source: O*NET. For full DWA descriptions, go to onetonline.org.

DWAs are logical units of analysis for hiring and promoting employees, as well as curriculum and training program development, because they transcend frequently changing industry staffing patterns and company–specific job descriptions.

A closer look at key frontline and operational positions

Below is a snapshot — including employee profiles, typical education and career paths, responsibilities and impacts of technology — for customer service representatives. These insights are the result of the research performed by the workforce strategies team at College for America — a nonprofit, accredited college dedicated to providing more accessible, workplace-applicable degree programs to working adults. Its findings reflect labor market data, real-time job listings and feedback from insurers nationwide.

Snapshot: Customer service representative

Source: Bureau of Labor Statistics

Tony had worked throughout high school at a local retail store. After graduation, he wanted to enter a career path that would offer advancement and tuition reimbursement so he could pursue a college degree. With the people and listening skills he learned from working retail, he was offered a position as a customer service representative at a life insurance company.

Before working with clients at his new position, Tony participated in the company’s training program to learn about products and services, customer management, departmental responsibilities and where to find information. He also learned telephone techniques to better interact with clients.

As a customer service representative, Tony spends his day answering questions, providing information to clients and resolving complaints. He has become adept at dealing with conflict, as his clients often call under stressful circumstances. Tony is currently taking courses at a local college and hopes to make his way into a sales position in his company.

Education

Customer service representative positions require a minimum of a high school diploma, though often employers are seeking people with an associate’s or bachelor’s degree. Representatives generally receive company-specific training before beginning work.

These positions provide an opportunity for individuals to learn the insurance business, and they serve as a stepping stone to other insurance careers.

Responsibilities

A customer service representative may be expected to:

Source: Bureau of Labor Statistics

Tony had worked throughout high school at a local retail store. After graduation, he wanted to enter a career path that would offer advancement and tuition reimbursement so he could pursue a college degree. With the people and listening skills he learned from working retail, he was offered a position as a customer service representative at a life insurance company.

Before working with clients at his new position, Tony participated in the company’s training program to learn about products and services, customer management, departmental responsibilities and where to find information. He also learned telephone techniques to better interact with clients.

As a customer service representative, Tony spends his day answering questions, providing information to clients and resolving complaints. He has become adept at dealing with conflict, as his clients often call under stressful circumstances. Tony is currently taking courses at a local college and hopes to make his way into a sales position in his company.

Education

Customer service representative positions require a minimum of a high school diploma, though often employers are seeking people with an associate’s or bachelor’s degree. Representatives generally receive company-specific training before beginning work.

These positions provide an opportunity for individuals to learn the insurance business, and they serve as a stepping stone to other insurance careers.

Responsibilities

A customer service representative may be expected to: