Incredible as it may seem, the average underwriter today spends seventy percent of their time on tasks unrelated to underwriting—creating a degree of (unnecessary) operational pain that stunts innovation, reduces efficiency, and undermines their true raison d’être: making the best, fastest risk selection decisions possible.

As a result, underwriters struggle to service all the submissions for coverage they receive. Responses back to brokers are often measured in weeks. In some cases, those frustrated brokers place their business with another carrier. In addition, underwriters will say that they usually are making decisions on less data and information than optimal.

The bottom line: Underwriting quality is declining, leading to poor risk selection, poor broker and customer experience, lost new business acquisition opportunities, and profit leakage.

As Jonathan McGoran noted in Risk & Insurance last December, “Roughly sixty percent of underwriters thought improvements needed to be made around the quality of their organizations’ processes and tools. They expressed much more confidence, however, in the skillset and capabilities of underwriting professionals as they perform their core functions.” Yet, “only a quarter of P&C underwriters reported that half or more of their underwriting process is automated, with robotic process automation (RPA) and natural language processing (NLP) seen as particularly deficient.”

The respondents listed priorities for future investments as predictive analytics, new underwriting platforms, business intelligence and reporting tools, customer/broker portals, and self-service solutions.

To free up the time necessary to allow underwriters to nurture broker relationships, price risk, and, ideally, optimize proper risk selection, and secure new business we must address the most common hurdles to success: inefficient processes, outdated systems, lack of information/analytics at the point of need, poor access or organization of underwriting information, and insufficient focus on training/talent development.

For the last 3 decades, the industry has been investing significantly in “Core Systems” like policy administration, claims, and billing. Yet, still today one of the most important insurance functions to “profitability & Growth” remains significantly under-automated, placing the burden on the underwriters themselves resulting in less than optimal underwriting quality and profit & growth leakage.

The window for addressing the decline in underwriting quality and the growing gaps in process automation, integration with legacy systems, customer and broker collaboration, and access to required data in a timely manner is closing fast. The technology is available today to address these hurdles without waiting to replace legacy systems or the maturity of new and emerging technologies. Leveraging technologies designed for integration with existing systems, including APIs and microservices, data lakes, and data mesh solutions, intelligent document processing technologies (e.g., RPA, NLP, AI) will automate the end-to-end underwriting process and improve performance.

In short, now is the time to focus on a “Core Systems Platform” to support the Underwriting Process. Leveraging an intelligent workflow automation approach to the deployment of an end-to-end automated underwriting platform (e.g., underwriting workbench) that insulates underwriters from having to jump between multiple systems to fulfill their tasks. Instead, data from diverse platforms can be made available to underwriters in the platform’s single, stable user interface.

The Opportunity

The opportunities to drive significant improvements in underwriting performance, broker/customer experience, and profitable growth are staring us in the face.

- Streamlines more efficient Improved Underwriting process

- Increased Underwriting capacity to support growth

- Improved risk selection and profitability

- Improved time to market of Underwriting decisions

- Improved Broker and Customer Experience

- Providing a foundation for straight-through processing for low complexity / fast flow risks

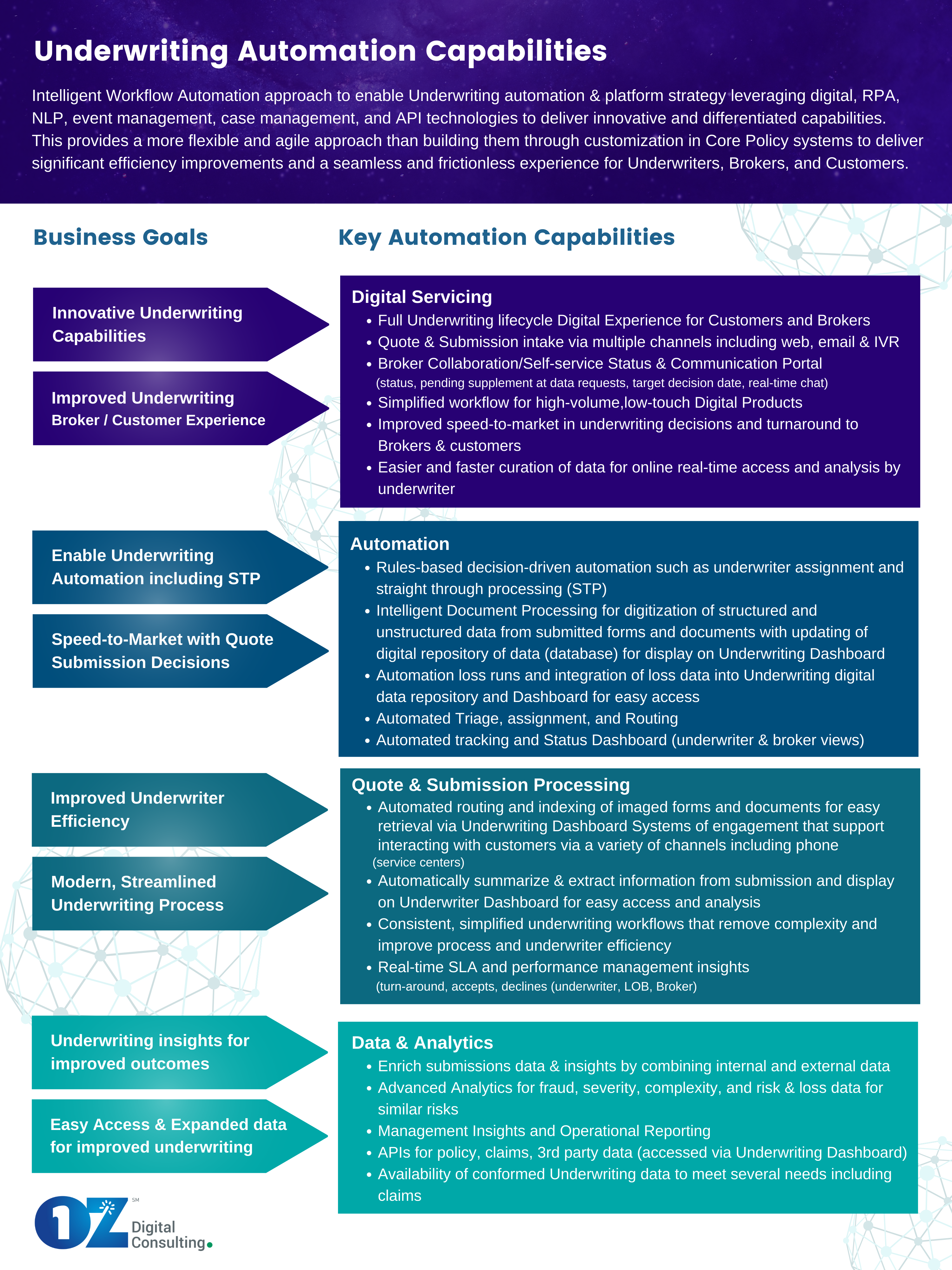

The New Underwriting Platform – Key Automation Capabilities

To realize these opportunities today’s target Underwriting Platform should seek to include the following automated capabilities.

Key automation capabilities include:

- Digitized Submission Ingestion

- Automated Triage & routing (RPA) and digitization (NLP) of Broker emails, forms, documents, and Big Data sources

- Collaboration and self-service portals

- Underwriting dashboard and integration APIs

- Underwriting Capacity Management & Assignment

- Automated Underwriter Assignment

- Rules-based assignment-driven authority, expertise availability & capacity

- Capacity & SLA Tracking, monitoring, & Reporting

- Manage Forms & Correspondence

- Broker & Client Collaboration & Communication

- Submission & UW Status via a self-service portal

- Communicate additional information requirements

- Status of Pending information & Document requests.

- Producers and underwriters can share documents, notes, and emails, providing real-time visibility into the submission process for new business, renewals, and endorsements

- Automatically Create and deliver forms as needed for clients and brokers (forms management & Automation)

Case Management & Tracking

- Centralize the work queues to provide an end-to-end view of the requests and interactions

- A holistic view of the submission, forms, documents, policy and claims information, underwriting notes and data, SLA performance, correspondence, etc.

- Analysis of Customer Risk & Rating Engine Input

- Pricing and client proposal

- Workflow automation to enable work will flow seamlessly and timely between Underwriting Branch offices & Operations.

Centralized and Easy Data Access

- Intelligent document automation using NLP to digitize documents, forms, and unstructured data for easy access and retrieval

- Real-time policy and claims data access (dashboard & APIs)

- Real-time 3rd Party data access (dashboard and APIs

- Improved naming and indexing of imaged documents and forms for easier access (dashboard, APIs, & RPA)

- A centralized, holistic view of underwriting data and original submissions (forms, documents, etc.)

Automation Strategy & Roadmap

While emerging technologies like ML and NLP are maturing quickly they are not a requirement to attain significant progress in the automation of the Underwriting process. Replacement of legacy core systems is also not a prerequisite for automation as target architecture solutions leveraging APIs and data lakes can enable real-time data access. RPA platforms have attained a significant level of maturity and can and are being used to automate many manual, repetitive activities and tasks. To address this issue, Insurers should develop an Underwriting Intelligent Workflow Automation Strategy and Roadmap that provides for incremental and continuous automation.

A typical strategy and road mapping Project to maximize profitability and growth will include:

- Define the business objectives and goals to be satisfied

- Define the future state workflow enabled by the automation capabilities

- Identify the corresponding automation opportunities and capabilities to meet those goals

- Identify and Access current and emerging technology solutions to provide automation capabilities, performing proof of concepts (POCs) as needed

- Design the target solution architecture and associated enabling technologies

- Develop a roadmap to deliver the target solution in incremental release

- Look to identify opportunities for continuous improvement and automation (inclusion of big data, predictive and prescriptive modeling, Ml and AI enriched data, etc.)

Overall, investing in Intelligent Workflow Automation of the Underwriting process, leveraging technologies such as predictive analytics, Al, ML, NLP, case and event management will help improve underwriting capacity, underwriting quality, and the ease of doing business for customers/producers leading to improvements in profitability and growth.

There will not be a better time nor a greater need for urgency than today to fill the void in your core systems portfolio to enable underwriters to do what they are highly trained and skilled to do – risk analysis, selection, and pricing.

Footnotes: The Institutes’ study was sponsored by Accenture, quoted in Risk & Insurance – We Talked to Hundreds of Insurance Underwriters. What They Have to Say May – Surprise You | Risk & Insurance

Sponsored by ITL Partner: OZ Digital Consulting