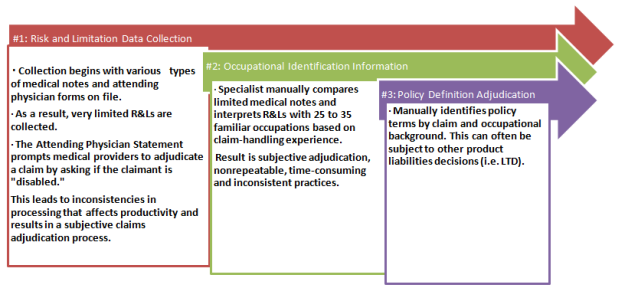

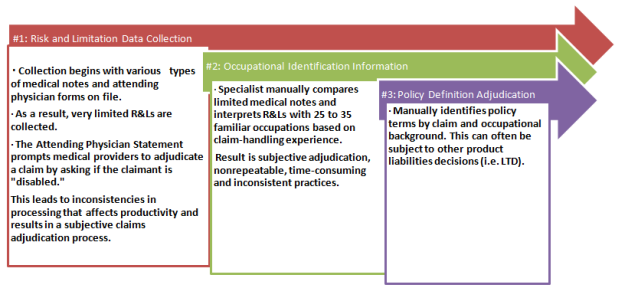

Insurers rely heavily on the Attending Physician Statement (APS) forms to collect medical status data. However, considering the high volume of claims per specialist and the time involved to manually process them, information contained in the APS isn’t always fully translated. Because of this, forms are often lacking the complete information required to fully understand the claim, based on a fair and accurate assessment of the claimant’s physical capabilities, restrictions and limitations. Moreover, this manual process makes it hard to ensure consistency throughout the duration of the claim.

For example, if the physician states that the claimant is unable to work and fails to provide a written medical basis in the APS forms regarding the decision, benefit specialists are unable to accurately assess and match the claim to the appropriate contractual definition of disability as defined in the claimant’s policy. This process makes it difficult to determine if the liability should be accepted or denied.

Managing the risk throughout the duration of the claim can influence claim outcomes by providing the opportunity for better claim management for both the insurer and the claimant.

The Long-Term Disability & Life Waiver Chokehold

It is not uncommon for consumers to have both their long-term disability (LTD) and life insurance with the same insurance carrier. So, when a person goes on disability, there are essentially two claims open and running simultaneously. The problem is the life waiver claims aren’t being treated as disability claims—which is, in reality, what they are.

What typically happens is the LTD claim becomes the driving force while the life waiver claim takes a backseat, often translating into processing delays. Even though these plans usually reflect two very distinct definitions (LTD claims begin as a two-year “own occupation” plan, while life waiver is usually “any occupation” provision from day one), the life waiver claim sits—waiting to see what the LTD claim is going to do first. The life waiver claim essentially becomes more of a contractual definition of secondary importance, and consequently is managed as such.

Insurance carriers must be diligent in applying adjudication decisions consistent with what is underwritten in the life waiver provisions of an insured’s policy, and not based on what’s happening with the LTD claim. This has become increasingly problematic as caseloads continue to grow and life waiver claims follow the LTD claim by default, increasing the insurer’s reserve liabilities (i.e., disability life reserves, morality life reserves and premium reimbursement liabilities), and risk exposure.

Unfortunately, once a disability has been accepted on a life waiver claim, there tends to be minimal risk management. Improved risk management in life waiver claims should include best practices that focus on understanding the severity, restrictions and limitations of the claimant, then matching claimant capabilities to the occupational policy terms.

Better Claim Monitoring, Better Results

What’s missing within life waiver processes is the ability to manage the claim block holistically with information derived from all necessary sources, and integrating it into a unified data platform. By doing this, insurers can quickly identify claimants that have occupational opportunities based on their specific physical capabilities, restrictions and limitations, education, experience, and training. But it doesn’t stop there.

Once an occupational opportunity has been determined, insurers can compare these findings to occupations identified by the department of labor and match the capabilities of the claimant to a specific occupation. In addition, medical details surrounding the claim should be updated continually and combined with historical data, as physical capabilities can change over the duration of the claim. This type of automated vocational support allows adjusters to fully evaluate the claimant’s condition for available occupation opportunities.

Considering the thousands of claims that are processed manually by examiners, it can be difficult to ensure that new claims and the recertification of claims are being completed on time, consistently, and in line with risk management best practices. This becomes an almost unmanageable task for examiners as they struggle to maintain the continuity required to reopen, examine, and research individual claims from day one. It is a continual problem because a claim that is approved today may look completely different a year from now.

“With technology, there is a great opportunity for insurers to make operational changes that will systematically improve their current adjudication processes and minimize the insurer’s reserve liabilities,” explains Thomas Capato, CEO of FastTrack RTW Services & Solutions, whose Life Waiver Tool is the first commercially available technology to automate the waiver of premium process. “This next-generation best practice will not only help improve internal productivity for life insurers but allow waiver reserves to be managed properly and improve future actuarial assumptions.”

An automated claim process allows for continual claim management and tracking that’s set to the claimant’s policy terms, ensuring that all follow-ups are done in a timely and consistent manner — without the need for manual intervention.

Summary

Every claim has unique situations, and insurers need to apply the right risk management principles to that particular claim. This can mean the addition of a single automated application, or perhaps a combination of many, internalizing processes to determine the best solution for enhancing risk management outcomes.

“Technology enhances the ability to fully capture specific information surrounding the nature of a claimant’s disability for better risk management within the life waiver block, providing insurers with an accurate profile of the person, the job, and occupational capabilities,” says Lester, at Legal & General America.

It’s time for life waiver processes to utilize technology to manage claims in a more efficient, effective, and standardized manner. By replacing manual claim tasks with the rigor of automated monitoring, insurers have the opportunity to optimize existing processes and improve overall operational efficiencies within their life waiver claim block. Moreover, it is this technology that can make consistent, supportable and repeatable real-time decisions, bringing value to both the insurer and the claimant.

Insurers rely heavily on the Attending Physician Statement (APS) forms to collect medical status data. However, considering the high volume of claims per specialist and the time involved to manually process them, information contained in the APS isn’t always fully translated. Because of this, forms are often lacking the complete information required to fully understand the claim, based on a fair and accurate assessment of the claimant’s physical capabilities, restrictions and limitations. Moreover, this manual process makes it hard to ensure consistency throughout the duration of the claim.

For example, if the physician states that the claimant is unable to work and fails to provide a written medical basis in the APS forms regarding the decision, benefit specialists are unable to accurately assess and match the claim to the appropriate contractual definition of disability as defined in the claimant’s policy. This process makes it difficult to determine if the liability should be accepted or denied.

Managing the risk throughout the duration of the claim can influence claim outcomes by providing the opportunity for better claim management for both the insurer and the claimant.

The Long-Term Disability & Life Waiver Chokehold

It is not uncommon for consumers to have both their long-term disability (LTD) and life insurance with the same insurance carrier. So, when a person goes on disability, there are essentially two claims open and running simultaneously. The problem is the life waiver claims aren’t being treated as disability claims—which is, in reality, what they are.

What typically happens is the LTD claim becomes the driving force while the life waiver claim takes a backseat, often translating into processing delays. Even though these plans usually reflect two very distinct definitions (LTD claims begin as a two-year “own occupation” plan, while life waiver is usually “any occupation” provision from day one), the life waiver claim sits—waiting to see what the LTD claim is going to do first. The life waiver claim essentially becomes more of a contractual definition of secondary importance, and consequently is managed as such.

Insurance carriers must be diligent in applying adjudication decisions consistent with what is underwritten in the life waiver provisions of an insured’s policy, and not based on what’s happening with the LTD claim. This has become increasingly problematic as caseloads continue to grow and life waiver claims follow the LTD claim by default, increasing the insurer’s reserve liabilities (i.e., disability life reserves, morality life reserves and premium reimbursement liabilities), and risk exposure.

Unfortunately, once a disability has been accepted on a life waiver claim, there tends to be minimal risk management. Improved risk management in life waiver claims should include best practices that focus on understanding the severity, restrictions and limitations of the claimant, then matching claimant capabilities to the occupational policy terms.

Better Claim Monitoring, Better Results

What’s missing within life waiver processes is the ability to manage the claim block holistically with information derived from all necessary sources, and integrating it into a unified data platform. By doing this, insurers can quickly identify claimants that have occupational opportunities based on their specific physical capabilities, restrictions and limitations, education, experience, and training. But it doesn’t stop there.

Once an occupational opportunity has been determined, insurers can compare these findings to occupations identified by the department of labor and match the capabilities of the claimant to a specific occupation. In addition, medical details surrounding the claim should be updated continually and combined with historical data, as physical capabilities can change over the duration of the claim. This type of automated vocational support allows adjusters to fully evaluate the claimant’s condition for available occupation opportunities.

Considering the thousands of claims that are processed manually by examiners, it can be difficult to ensure that new claims and the recertification of claims are being completed on time, consistently, and in line with risk management best practices. This becomes an almost unmanageable task for examiners as they struggle to maintain the continuity required to reopen, examine, and research individual claims from day one. It is a continual problem because a claim that is approved today may look completely different a year from now.

“With technology, there is a great opportunity for insurers to make operational changes that will systematically improve their current adjudication processes and minimize the insurer’s reserve liabilities,” explains Thomas Capato, CEO of FastTrack RTW Services & Solutions, whose Life Waiver Tool is the first commercially available technology to automate the waiver of premium process. “This next-generation best practice will not only help improve internal productivity for life insurers but allow waiver reserves to be managed properly and improve future actuarial assumptions.”

An automated claim process allows for continual claim management and tracking that’s set to the claimant’s policy terms, ensuring that all follow-ups are done in a timely and consistent manner — without the need for manual intervention.

Summary

Every claim has unique situations, and insurers need to apply the right risk management principles to that particular claim. This can mean the addition of a single automated application, or perhaps a combination of many, internalizing processes to determine the best solution for enhancing risk management outcomes.

“Technology enhances the ability to fully capture specific information surrounding the nature of a claimant’s disability for better risk management within the life waiver block, providing insurers with an accurate profile of the person, the job, and occupational capabilities,” says Lester, at Legal & General America.

It’s time for life waiver processes to utilize technology to manage claims in a more efficient, effective, and standardized manner. By replacing manual claim tasks with the rigor of automated monitoring, insurers have the opportunity to optimize existing processes and improve overall operational efficiencies within their life waiver claim block. Moreover, it is this technology that can make consistent, supportable and repeatable real-time decisions, bringing value to both the insurer and the claimant.Life Waiver of Premium Part 2: Optimizing Claim Management Operations

It’s time for life waiver processes to utilize technology to manage claims in a more efficient, effective, and standardized manner.|

Insurers rely heavily on the Attending Physician Statement (APS) forms to collect medical status data. However, considering the high volume of claims per specialist and the time involved to manually process them, information contained in the APS isn’t always fully translated. Because of this, forms are often lacking the complete information required to fully understand the claim, based on a fair and accurate assessment of the claimant’s physical capabilities, restrictions and limitations. Moreover, this manual process makes it hard to ensure consistency throughout the duration of the claim.

For example, if the physician states that the claimant is unable to work and fails to provide a written medical basis in the APS forms regarding the decision, benefit specialists are unable to accurately assess and match the claim to the appropriate contractual definition of disability as defined in the claimant’s policy. This process makes it difficult to determine if the liability should be accepted or denied.

Managing the risk throughout the duration of the claim can influence claim outcomes by providing the opportunity for better claim management for both the insurer and the claimant.

The Long-Term Disability & Life Waiver Chokehold

It is not uncommon for consumers to have both their long-term disability (LTD) and life insurance with the same insurance carrier. So, when a person goes on disability, there are essentially two claims open and running simultaneously. The problem is the life waiver claims aren’t being treated as disability claims—which is, in reality, what they are.

What typically happens is the LTD claim becomes the driving force while the life waiver claim takes a backseat, often translating into processing delays. Even though these plans usually reflect two very distinct definitions (LTD claims begin as a two-year “own occupation” plan, while life waiver is usually “any occupation” provision from day one), the life waiver claim sits—waiting to see what the LTD claim is going to do first. The life waiver claim essentially becomes more of a contractual definition of secondary importance, and consequently is managed as such.

Insurance carriers must be diligent in applying adjudication decisions consistent with what is underwritten in the life waiver provisions of an insured’s policy, and not based on what’s happening with the LTD claim. This has become increasingly problematic as caseloads continue to grow and life waiver claims follow the LTD claim by default, increasing the insurer’s reserve liabilities (i.e., disability life reserves, morality life reserves and premium reimbursement liabilities), and risk exposure.

Unfortunately, once a disability has been accepted on a life waiver claim, there tends to be minimal risk management. Improved risk management in life waiver claims should include best practices that focus on understanding the severity, restrictions and limitations of the claimant, then matching claimant capabilities to the occupational policy terms.

Better Claim Monitoring, Better Results

What’s missing within life waiver processes is the ability to manage the claim block holistically with information derived from all necessary sources, and integrating it into a unified data platform. By doing this, insurers can quickly identify claimants that have occupational opportunities based on their specific physical capabilities, restrictions and limitations, education, experience, and training. But it doesn’t stop there.

Once an occupational opportunity has been determined, insurers can compare these findings to occupations identified by the department of labor and match the capabilities of the claimant to a specific occupation. In addition, medical details surrounding the claim should be updated continually and combined with historical data, as physical capabilities can change over the duration of the claim. This type of automated vocational support allows adjusters to fully evaluate the claimant’s condition for available occupation opportunities.

Considering the thousands of claims that are processed manually by examiners, it can be difficult to ensure that new claims and the recertification of claims are being completed on time, consistently, and in line with risk management best practices. This becomes an almost unmanageable task for examiners as they struggle to maintain the continuity required to reopen, examine, and research individual claims from day one. It is a continual problem because a claim that is approved today may look completely different a year from now.

“With technology, there is a great opportunity for insurers to make operational changes that will systematically improve their current adjudication processes and minimize the insurer’s reserve liabilities,” explains Thomas Capato, CEO of FastTrack RTW Services & Solutions, whose Life Waiver Tool is the first commercially available technology to automate the waiver of premium process. “This next-generation best practice will not only help improve internal productivity for life insurers but allow waiver reserves to be managed properly and improve future actuarial assumptions.”

An automated claim process allows for continual claim management and tracking that’s set to the claimant’s policy terms, ensuring that all follow-ups are done in a timely and consistent manner — without the need for manual intervention.

Summary

Every claim has unique situations, and insurers need to apply the right risk management principles to that particular claim. This can mean the addition of a single automated application, or perhaps a combination of many, internalizing processes to determine the best solution for enhancing risk management outcomes.

“Technology enhances the ability to fully capture specific information surrounding the nature of a claimant’s disability for better risk management within the life waiver block, providing insurers with an accurate profile of the person, the job, and occupational capabilities,” says Lester, at Legal & General America.

It’s time for life waiver processes to utilize technology to manage claims in a more efficient, effective, and standardized manner. By replacing manual claim tasks with the rigor of automated monitoring, insurers have the opportunity to optimize existing processes and improve overall operational efficiencies within their life waiver claim block. Moreover, it is this technology that can make consistent, supportable and repeatable real-time decisions, bringing value to both the insurer and the claimant.

Insurers rely heavily on the Attending Physician Statement (APS) forms to collect medical status data. However, considering the high volume of claims per specialist and the time involved to manually process them, information contained in the APS isn’t always fully translated. Because of this, forms are often lacking the complete information required to fully understand the claim, based on a fair and accurate assessment of the claimant’s physical capabilities, restrictions and limitations. Moreover, this manual process makes it hard to ensure consistency throughout the duration of the claim.

For example, if the physician states that the claimant is unable to work and fails to provide a written medical basis in the APS forms regarding the decision, benefit specialists are unable to accurately assess and match the claim to the appropriate contractual definition of disability as defined in the claimant’s policy. This process makes it difficult to determine if the liability should be accepted or denied.

Managing the risk throughout the duration of the claim can influence claim outcomes by providing the opportunity for better claim management for both the insurer and the claimant.

The Long-Term Disability & Life Waiver Chokehold

It is not uncommon for consumers to have both their long-term disability (LTD) and life insurance with the same insurance carrier. So, when a person goes on disability, there are essentially two claims open and running simultaneously. The problem is the life waiver claims aren’t being treated as disability claims—which is, in reality, what they are.

What typically happens is the LTD claim becomes the driving force while the life waiver claim takes a backseat, often translating into processing delays. Even though these plans usually reflect two very distinct definitions (LTD claims begin as a two-year “own occupation” plan, while life waiver is usually “any occupation” provision from day one), the life waiver claim sits—waiting to see what the LTD claim is going to do first. The life waiver claim essentially becomes more of a contractual definition of secondary importance, and consequently is managed as such.

Insurance carriers must be diligent in applying adjudication decisions consistent with what is underwritten in the life waiver provisions of an insured’s policy, and not based on what’s happening with the LTD claim. This has become increasingly problematic as caseloads continue to grow and life waiver claims follow the LTD claim by default, increasing the insurer’s reserve liabilities (i.e., disability life reserves, morality life reserves and premium reimbursement liabilities), and risk exposure.

Unfortunately, once a disability has been accepted on a life waiver claim, there tends to be minimal risk management. Improved risk management in life waiver claims should include best practices that focus on understanding the severity, restrictions and limitations of the claimant, then matching claimant capabilities to the occupational policy terms.

Better Claim Monitoring, Better Results

What’s missing within life waiver processes is the ability to manage the claim block holistically with information derived from all necessary sources, and integrating it into a unified data platform. By doing this, insurers can quickly identify claimants that have occupational opportunities based on their specific physical capabilities, restrictions and limitations, education, experience, and training. But it doesn’t stop there.

Once an occupational opportunity has been determined, insurers can compare these findings to occupations identified by the department of labor and match the capabilities of the claimant to a specific occupation. In addition, medical details surrounding the claim should be updated continually and combined with historical data, as physical capabilities can change over the duration of the claim. This type of automated vocational support allows adjusters to fully evaluate the claimant’s condition for available occupation opportunities.

Considering the thousands of claims that are processed manually by examiners, it can be difficult to ensure that new claims and the recertification of claims are being completed on time, consistently, and in line with risk management best practices. This becomes an almost unmanageable task for examiners as they struggle to maintain the continuity required to reopen, examine, and research individual claims from day one. It is a continual problem because a claim that is approved today may look completely different a year from now.

“With technology, there is a great opportunity for insurers to make operational changes that will systematically improve their current adjudication processes and minimize the insurer’s reserve liabilities,” explains Thomas Capato, CEO of FastTrack RTW Services & Solutions, whose Life Waiver Tool is the first commercially available technology to automate the waiver of premium process. “This next-generation best practice will not only help improve internal productivity for life insurers but allow waiver reserves to be managed properly and improve future actuarial assumptions.”

An automated claim process allows for continual claim management and tracking that’s set to the claimant’s policy terms, ensuring that all follow-ups are done in a timely and consistent manner — without the need for manual intervention.

Summary

Every claim has unique situations, and insurers need to apply the right risk management principles to that particular claim. This can mean the addition of a single automated application, or perhaps a combination of many, internalizing processes to determine the best solution for enhancing risk management outcomes.

“Technology enhances the ability to fully capture specific information surrounding the nature of a claimant’s disability for better risk management within the life waiver block, providing insurers with an accurate profile of the person, the job, and occupational capabilities,” says Lester, at Legal & General America.

It’s time for life waiver processes to utilize technology to manage claims in a more efficient, effective, and standardized manner. By replacing manual claim tasks with the rigor of automated monitoring, insurers have the opportunity to optimize existing processes and improve overall operational efficiencies within their life waiver claim block. Moreover, it is this technology that can make consistent, supportable and repeatable real-time decisions, bringing value to both the insurer and the claimant.

The real goal of predictive analytics for self-insureds is to help guide and support risk managers’ decisions. Predictive analytics can be applied to both ‘pre-claim’ and ‘post-claim’ loss prevention methods. To aid in claim prevention, pre-claim-focused analyses are used to highlight high-risk (high-cost) employees. The loss costs of various groups are compared to each other, a company average, and to average industry loss costs provided by the National Council on Compensation Insurance (NCCI). Loss categories higher than company or NCCI averages get closer examinations for loss drivers and mitigation strategies. A higher-than-average cost for newly hired employees may signal a need for more training. A higher-than-industry cost for claims in certain states may be noted. A particular type of injury may emerge as the most costly. The potential savings can be estimated as the difference between the current loss costs and the benchmark loss costs, times the percentage of employees or expected claims involved. For example, a self-insured entity may know that its newly hired employees experience a larger proportion of losses than employees with longer tenure. If it conducts an analysis and discovers that low-wage employees working in Illinois with less than six months of experience have substantially higher costs than the average employee, claim prevention resources could be specifically aimed at that employee demographic to control costs. Savings Opportunities A notable benefit of predictive analytics is that it provides quantitative cost-saving information to risk managers. Continuing with the prior example, assume 2,500 employees are newly hired, low-wage employees in Illinois and their average costs have been shown to be three times higher than the company average of USD $1.50/$100 of payroll. We can estimate that a reduction from $4.50 to $1.50 could create $2.25 million in savings. Asking senior management for $100,000 for more new hire training in Illinois facilities will be much easier with the quantitative support provided by predictive analytics. (2,500 employees with an average payroll of $30,000 save $3 = 2,500 x 30,000/100 x 3 = $2.25M) Not only can predictive analytics assist with reducing cost ‘pre-claim’ by focusing on exposure, it can also reduce costs once a claim has occurred. Knowing the easy-to-identify large claims will be second nature to risk managers, however, ‘post-claim’ predictive analytics can look into claim development details to find characteristics that late-developing, problematic claims (and often not the obvious large ones) have in common. After a loss has occurred, one of the most effective ways to manage costs is to involve a very experienced claims handler as soon as possible. The results of effective ‘post-claim’ predictive analyses will assist in implementing cost-saving claims triage. Because the best resource post-claim is good claim management, predictive analytics can get late-developing, problematic claims the timely attention they need to contain the ultimate costs or even settle the claim. Loss savings based on predictive analyses extend beyond claim cost reduction. Being able to quantitatively show potential savings and concrete mitigation plans will make a positive impression on senior company management and excess insurance carriers. Demonstrating shrewd knowledge of the loss drivers and material plans to reduce the losses can aid in premium negotiations with excess carriers for all future policy years. And if the insurer or state is holding any collateral, the predictive analytics' results can be used by the self-insured in negotiating. The key to unlocking further potential cost savings in your self-insured plan is readily available in your own data. Predictive analytics is the tool that will help risk managers make better claim reduction decisions and produce actionable items with real cost savings now and in the future. Risk managers and self-insured companies can look forward to possible benefits such as loss cost reductions along with reductions in excess premium and collateral, and quantitative information to help them with budgeting and allocation. As more self-insureds begin applying predictive analytics to control costs, companies that are not using these tools will be at a competitive disadvantage. For more information on predictive analytics, watch this video of a Google hangout with Michael Paczolt and Terry Wade of Milliman, Inc.:

The real goal of predictive analytics for self-insureds is to help guide and support risk managers’ decisions. Predictive analytics can be applied to both ‘pre-claim’ and ‘post-claim’ loss prevention methods. To aid in claim prevention, pre-claim-focused analyses are used to highlight high-risk (high-cost) employees. The loss costs of various groups are compared to each other, a company average, and to average industry loss costs provided by the National Council on Compensation Insurance (NCCI). Loss categories higher than company or NCCI averages get closer examinations for loss drivers and mitigation strategies. A higher-than-average cost for newly hired employees may signal a need for more training. A higher-than-industry cost for claims in certain states may be noted. A particular type of injury may emerge as the most costly. The potential savings can be estimated as the difference between the current loss costs and the benchmark loss costs, times the percentage of employees or expected claims involved. For example, a self-insured entity may know that its newly hired employees experience a larger proportion of losses than employees with longer tenure. If it conducts an analysis and discovers that low-wage employees working in Illinois with less than six months of experience have substantially higher costs than the average employee, claim prevention resources could be specifically aimed at that employee demographic to control costs. Savings Opportunities A notable benefit of predictive analytics is that it provides quantitative cost-saving information to risk managers. Continuing with the prior example, assume 2,500 employees are newly hired, low-wage employees in Illinois and their average costs have been shown to be three times higher than the company average of USD $1.50/$100 of payroll. We can estimate that a reduction from $4.50 to $1.50 could create $2.25 million in savings. Asking senior management for $100,000 for more new hire training in Illinois facilities will be much easier with the quantitative support provided by predictive analytics. (2,500 employees with an average payroll of $30,000 save $3 = 2,500 x 30,000/100 x 3 = $2.25M) Not only can predictive analytics assist with reducing cost ‘pre-claim’ by focusing on exposure, it can also reduce costs once a claim has occurred. Knowing the easy-to-identify large claims will be second nature to risk managers, however, ‘post-claim’ predictive analytics can look into claim development details to find characteristics that late-developing, problematic claims (and often not the obvious large ones) have in common. After a loss has occurred, one of the most effective ways to manage costs is to involve a very experienced claims handler as soon as possible. The results of effective ‘post-claim’ predictive analyses will assist in implementing cost-saving claims triage. Because the best resource post-claim is good claim management, predictive analytics can get late-developing, problematic claims the timely attention they need to contain the ultimate costs or even settle the claim. Loss savings based on predictive analyses extend beyond claim cost reduction. Being able to quantitatively show potential savings and concrete mitigation plans will make a positive impression on senior company management and excess insurance carriers. Demonstrating shrewd knowledge of the loss drivers and material plans to reduce the losses can aid in premium negotiations with excess carriers for all future policy years. And if the insurer or state is holding any collateral, the predictive analytics' results can be used by the self-insured in negotiating. The key to unlocking further potential cost savings in your self-insured plan is readily available in your own data. Predictive analytics is the tool that will help risk managers make better claim reduction decisions and produce actionable items with real cost savings now and in the future. Risk managers and self-insured companies can look forward to possible benefits such as loss cost reductions along with reductions in excess premium and collateral, and quantitative information to help them with budgeting and allocation. As more self-insureds begin applying predictive analytics to control costs, companies that are not using these tools will be at a competitive disadvantage. For more information on predictive analytics, watch this video of a Google hangout with Michael Paczolt and Terry Wade of Milliman, Inc.: