KEY TAKEAWAY:

--If a causal, legal link between an industry’s actions and the exacerbation of climate change can be directly demonstrated, climate-related property losses could become recoverable from defendants within that industry. Property insurers could then begin to seek recovery from companies proven to be at fault. A new area of liability subrogation would begin, one which makes liability insurers liable for perils they never intended to underwrite.

----------

Pointing fingers in court over the impacts of climate change is increasingly popular. According to a report by the UN Environment Program and Columbia University, the number of suits over the fallout from global warming has more than doubled during the past five years. The impacts range from arsenic in rice tainting baby food, to more intensive rainfall driving flash floods. About three-quarters of the actions are in the U.S.

Seeking monetary remedy from private industries for their part in causing damage to the climate is not an entirely new idea. Corporate responsibility has been well established in cases of pollution, for example, when companies have been held responsible for spills or other discharges of waste products. It remains to be seen if courts will level a similar consensus over the liability of companies due to the effects of climate change on third parties.

Governments have already been found wanting, and blame assigned. In the first-ever constitutional climate trial in the U.S., 16 young people in Montana successfully challenged their state government for permitting fossil-fuel developments without considering the impact of greenhouse gases. The state court upheld their claim that their rights under the Montana state constitution’s guarantee of a safe environment were violated by various state actions. Similar actions are underway in Hawaii and other states, and around the world in the European Court of Human Rights, Sweden and many other jurisdictions.

See also: Review of 2023 Atlantic Hurricane Season

Connecting the causality dots

If a causal, legal link between an industry’s actions and the exacerbation of climate change can be directly demonstrated, climate-related property losses could become recoverable from defendants within that industry. Property insurers could then begin to seek recovery from companies proven to be at fault. A new area of liability subrogation would begin, one which makes liability insurers liable for perils they never intended to underwrite. If, meanwhile, the observed increasing intensity of flood events induced by precipitation is related causally to human-induced climate change, the property insurance landscape would change dramatically. Subrogation of insurance is theoretically possible, but establishing this causality will prove complex.

Flood requires two chief catalysts. First is the storm itself. It is an atmospheric phenomenon understood as a natural hazard. The second is the conditions on the ground. These may be the result of the actions of humans (such as the intentional opening of a levee). The second catalyst is readily acknowledged as actionable, but the first is not.

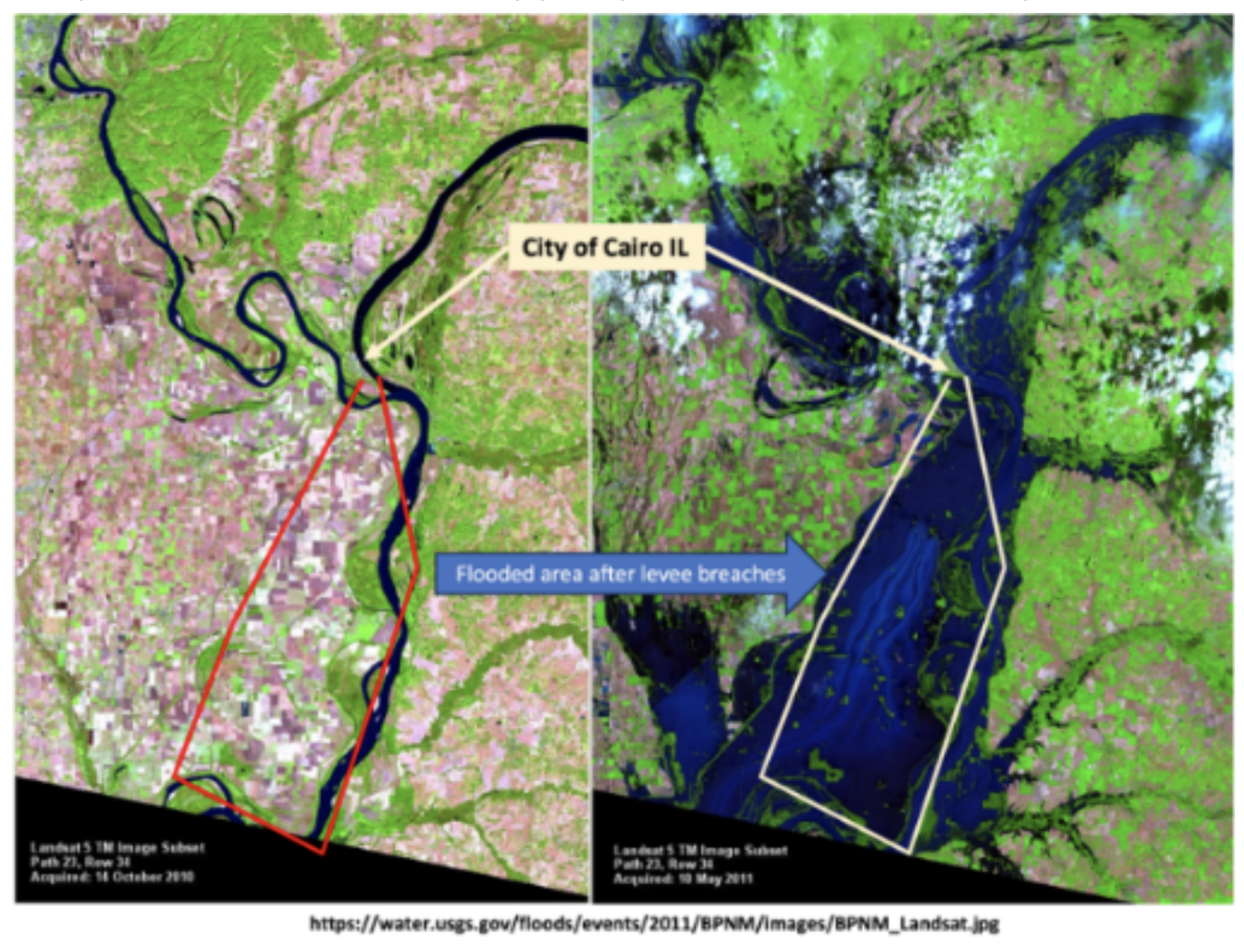

Actions have already been brought against third parties to recover the cost of flood damage to property when human action has caused the loss. It happened in 2011, for example, after Federal officials called in the military to protect the small town of Cairo, Illinois from the rapidly rising Mississippi River. Blaming resulting water damage to their farmland and homes on the decision to bulldoze through a protective levee, 25 property owners sued, seeking compensation for their losses.

The case was dismissed, but the federal government provided reimbursements, even though no government insurance had been intended prior to the suit. (The opened sections were intended as “fuse plugs” to be treated as safety relief valves.) Other legal recovery opportunities arising from human actions also have precedent. For example, inappropriate building in a floodway has been cited as justification for claims subrogation.

From physical to natural

As for the first catalyst of flood events – the storm itself – it has not heretofore been possible to sue a human entity for changing the weather. However, the Montana case shows that the “natural phenomenon” exemption from liability may no longer hold. More and more court cases around the world argue that one or another anthropomorphic third-party organization is responsible for altering the course of atmospheric phenomena and therefore should be held liable for the property damage the changed weather causes.

The phenomenon is not limited to flooding. Earthquake damage is caused by a combination of faults in the Earth’s crust and insufficiently robust construction. The former is a natural hazard, but the latter could be construed as a result of human error. However, the first fact may no longer hold water (pun intended). Earthquakes in Oklahoma, Texas and Pennsylvania – albeit small ones – are being seen as a result of nearby fracking activity.

Similarly, wildfire, a former natural-only hazard, is now often blamed on a utility company and has become an actionable loss. Subrogations by insurers against power suppliers have been enormous. For example, a subrogation claims settlement between Southern California Edison and insurance subrogation claimants for the 2017 Thomas and Koenigstein fires and the 2018 Montecito mudslides totaled $1.16 billion. No admission of wrongdoing or liability was made, but the basis of the claims is the utilities’ direct responsibility for sources of ignition.

However, climate-related increase in the dryness of woodlands and grasslands is a further factor, as is increased frequency of lightning strikes. These phenomena could drag climate-affecting industries into the fray.

See also: U.S. Is Ready for Parametric Flood Insurance

Flood: the next unnatural hazard?

It has long been argued that human-caused climate change is not proven as a direct cause of increased flood losses. The connection is intuitively apparent, but is it really a driving factor? Human development in flood-prone areas, inadequate and aging infrastructure and increased runoff all contribute to flood severity risk. All are the product of human actions, but they do not subvert the natural nature of the underlying event.

However, as with other climate litigation, proof (or evidence, at least) may be coming. Stanford University researchers have published an initial analysis that concludes that climate-changed induced increases in precipitation accounted for 36% of the actual flooding costs that occurred in the U.S. between 1988 and 2017. Lead author Frances Davenport from the School of Earth, Energy & Environmental Sciences wrote: “Even in states where the long-term mean precipitation hasn’t changed, in most cases the wettest events have intensified, increasing the financial damages relative to what would have occurred without the changes in precipitation.”

If climate change is shown conclusively to be driven by human activity, expect to see increases in event severity as actionable. It may be difficult to pin down a particular defendant, but that probably means only that claimants will cast a wider net in their effort to cast blame for altering the nature of natural events.