“Blockchain will transform the world.... Distributed ledger technology represents the biggest change to the business world since the adoption of double-entry accounting centuries ago.... Every industry will experience upheaval as blockchain becomes the foundation of the new business environment.”

This type of hyperbole is common today when discussing blockchain technology. The key questions for business leaders are about how much is hype and how much is reality. Insurance executives are asking, “What’s the real story?”

SMA recently asked insurance executives for their views on blockchain to determine the level of awareness in the industry and their expectations about business use and value. The title of a new SMA Research Brief provides the main storyline, Blockchain in Insurance: Awareness Grows, Activity Still Limited. Compared with just one year ago, awareness has increased significantly. This is not surprising because blockchain articles, videos and speeches are a dime a dozen these days. Many insurers have been to workshops, singled out individuals to become subject matter experts and even joined consortiums related to blockchain. Education and understanding are growing steadily across the industry.

See also: Blockchain: Basis for TomorrowA handful of well-publicized projects leveraging blockchain have been undertaken, and some insurers have experimented with the technology, but the vast majority of insurers are in the watch-and-wait mode. Even so, insurers are beginning to see the potential. In addition to the digital currencies such as Bitcoin that first raised the visibility of blockchain, insurers expect the tech to be an important enabler for microinsurance, peer-to-peer insurance, asset tracking and authentication, smart contracts and the exchange of sensitive information and documents. P&C commercial lines insurers see the most potential, given the more complex nature of their products and their ecosystem of partners.

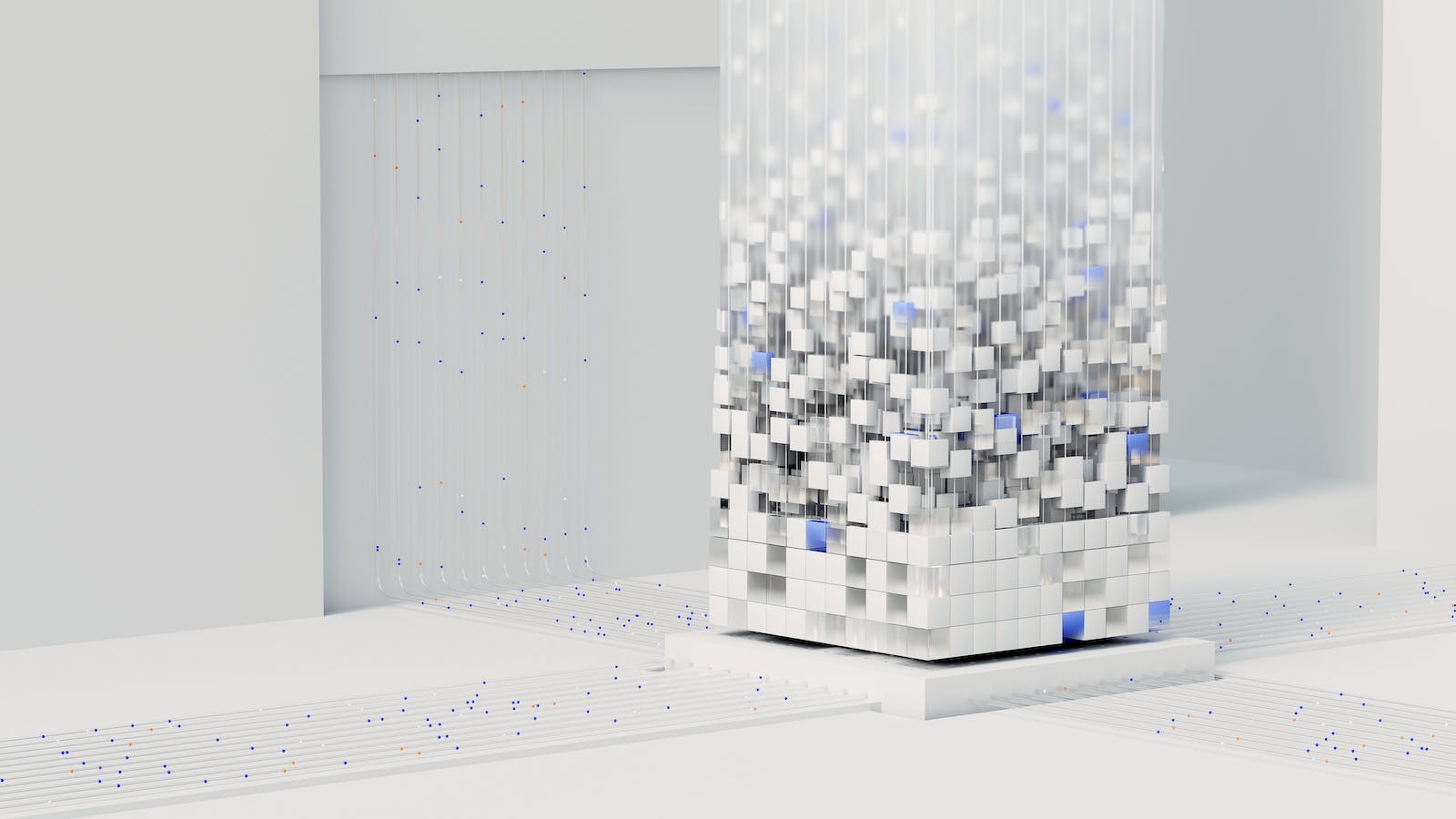

Blockchain may well become foundational to the business world and pervasive in insurance, but it is likely to evolve gradually over the next decade. Ultimately, the technology may become invisible, just a natural part of the digital infrastructure that runs the world, much like key emerging technologies of a prior age. Once-highly-touted technologies such as TCP/IP and HTTP are rarely discussed in business circles today – they are just there behind the scenes as pervasive enablers of the internet and the digital world. A similar trajectory may await blockchain.

So, the real story? Yes, blockchain is vitally important, and it is a technology with the potential to transform the way the world conducts business. But, as its usage evolves and expands across insurance and other industries over the next couple of decades, it will become less hyped and more of a standard building block.