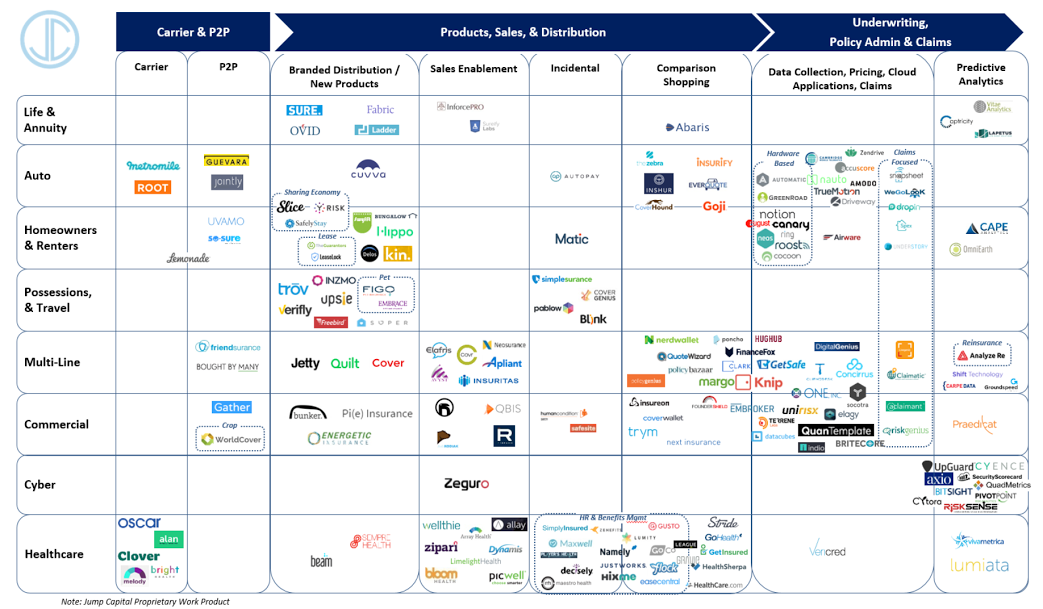

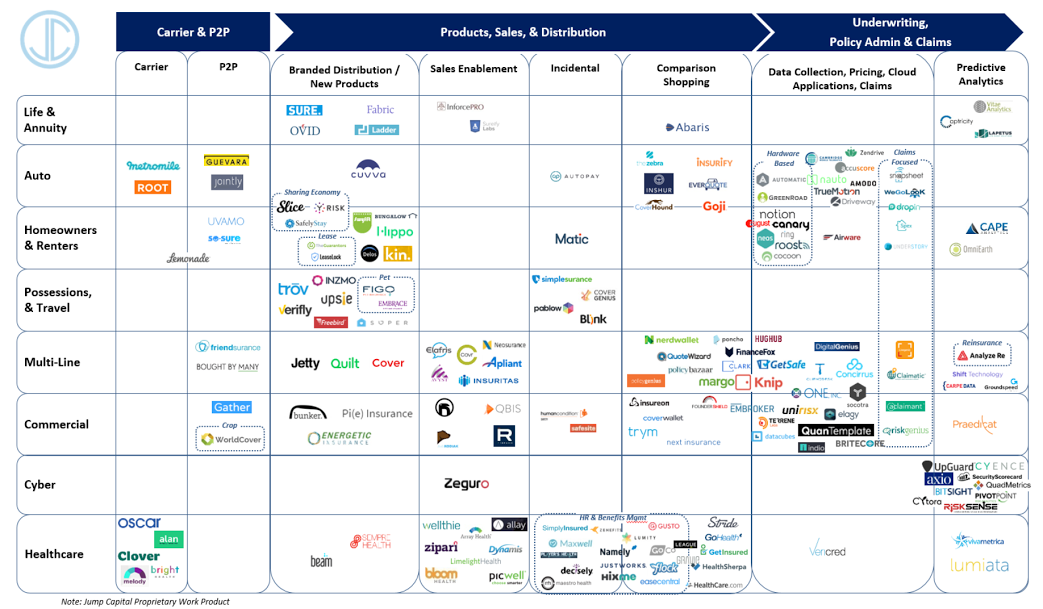

These companies are finding different ways to meet consumer demands and remove the complexity associated with the insurance industry. The companies included in the healthcare segment of this infographic are, for the most part, delivering new ways to help consumers find, buy and receive health insurance. Collectively, health insurtech platforms answer a consumer cry for help. But none of these platforms are functional, let alone useful, without a foundational layer of quality data on which to build.

What are the innovators creating?

Health insurtech innovators are working to answer a variety of consumer demands. They’re creating tools that simplify the health insurance shopping experience. Tools that help doctors find prescription drugs that are covered by a patient’s insurance plan. Tools that help consumers find doctors that are in-network. The problems that these platforms solve are many.

Here are just a few examples of innovative tools and features being created to deliver value to health insurance consumers:

1. Decision Support Tools for the Individual Market

A variety of web-based entities (WBEs) have popped up to help individual consumers find and purchase a health insurance plan that is right for them. PolicyGenius is a good example of an innovative platform doing just that. The company prides itself on delivering simple benefits that are personally designed for the individual. A consumer enters a few bits of information, and PolicyGenius recommends health insurance plans for that individual -- all delivered through a seamless digital experience.

2. Analysis Tools for the Small Group Market

Certain broker-facing platforms are starting to build analytical tools that help strengthen group health plan recommendations. These tools allow platforms to compare and contrast different health plans, including each plan’s network, aiding in disruption analysis and delivering value to their employer customers.

3. In-Network Provider Search and Notification Features

Many health insurtech platforms offer customers provider-network search and notification features. Stroll Health, for example, delivers personal recommendations for imaging centers based on a patient’s insurance plan. And some HR and benefits administration platforms now have the ability to notify employees if an employee’s preferred doctor drops out of network. Thoughtful features like these save consumers time and money.

See also: Next Step: Merging Big Data and AI

Why is the data so crucial?

While data may not be the sexiest element of a tech platform, the data layer enables all features. For example, for those broker-facing analysis tools to be useful, the broker platform must have access to accurate and timely data on the benefits and rates of every health plan they’ll compare. For an HR and benefits administration platform to alert an employee when a doctor drops out of network, the platform must first know when that doctor drops out of network. This means the platform must have access to an accurate and extremely granular database of providers in the specific network being tracked. Quality data is what informs today’s innovators, pushing them to take action and build exciting applications that solve real problems.

Health is a complex space, but there are many brilliant minds working to improve the health insurance industry. Putting the right data into the hands of these innovators allows them to do what they do best -- solve problems with creative technology solutions. Continuing to do this will allow today’s innovators to respond to consumer pain points and transform the health insurance industry.

These companies are finding different ways to meet consumer demands and remove the complexity associated with the insurance industry. The companies included in the healthcare segment of this infographic are, for the most part, delivering new ways to help consumers find, buy and receive health insurance. Collectively, health insurtech platforms answer a consumer cry for help. But none of these platforms are functional, let alone useful, without a foundational layer of quality data on which to build.

What are the innovators creating?

Health insurtech innovators are working to answer a variety of consumer demands. They’re creating tools that simplify the health insurance shopping experience. Tools that help doctors find prescription drugs that are covered by a patient’s insurance plan. Tools that help consumers find doctors that are in-network. The problems that these platforms solve are many.

Here are just a few examples of innovative tools and features being created to deliver value to health insurance consumers:

1. Decision Support Tools for the Individual Market

A variety of web-based entities (WBEs) have popped up to help individual consumers find and purchase a health insurance plan that is right for them. PolicyGenius is a good example of an innovative platform doing just that. The company prides itself on delivering simple benefits that are personally designed for the individual. A consumer enters a few bits of information, and PolicyGenius recommends health insurance plans for that individual -- all delivered through a seamless digital experience.

2. Analysis Tools for the Small Group Market

Certain broker-facing platforms are starting to build analytical tools that help strengthen group health plan recommendations. These tools allow platforms to compare and contrast different health plans, including each plan’s network, aiding in disruption analysis and delivering value to their employer customers.

3. In-Network Provider Search and Notification Features

Many health insurtech platforms offer customers provider-network search and notification features. Stroll Health, for example, delivers personal recommendations for imaging centers based on a patient’s insurance plan. And some HR and benefits administration platforms now have the ability to notify employees if an employee’s preferred doctor drops out of network. Thoughtful features like these save consumers time and money.

See also: Next Step: Merging Big Data and AI

Why is the data so crucial?

While data may not be the sexiest element of a tech platform, the data layer enables all features. For example, for those broker-facing analysis tools to be useful, the broker platform must have access to accurate and timely data on the benefits and rates of every health plan they’ll compare. For an HR and benefits administration platform to alert an employee when a doctor drops out of network, the platform must first know when that doctor drops out of network. This means the platform must have access to an accurate and extremely granular database of providers in the specific network being tracked. Quality data is what informs today’s innovators, pushing them to take action and build exciting applications that solve real problems.

Health is a complex space, but there are many brilliant minds working to improve the health insurance industry. Putting the right data into the hands of these innovators allows them to do what they do best -- solve problems with creative technology solutions. Continuing to do this will allow today’s innovators to respond to consumer pain points and transform the health insurance industry.Big Data? How About Quality Data?

Quality data is driving actionable insights for health insurance innovators to improve choice, transparency and user experience.

These companies are finding different ways to meet consumer demands and remove the complexity associated with the insurance industry. The companies included in the healthcare segment of this infographic are, for the most part, delivering new ways to help consumers find, buy and receive health insurance. Collectively, health insurtech platforms answer a consumer cry for help. But none of these platforms are functional, let alone useful, without a foundational layer of quality data on which to build.

What are the innovators creating?

Health insurtech innovators are working to answer a variety of consumer demands. They’re creating tools that simplify the health insurance shopping experience. Tools that help doctors find prescription drugs that are covered by a patient’s insurance plan. Tools that help consumers find doctors that are in-network. The problems that these platforms solve are many.

Here are just a few examples of innovative tools and features being created to deliver value to health insurance consumers:

1. Decision Support Tools for the Individual Market

A variety of web-based entities (WBEs) have popped up to help individual consumers find and purchase a health insurance plan that is right for them. PolicyGenius is a good example of an innovative platform doing just that. The company prides itself on delivering simple benefits that are personally designed for the individual. A consumer enters a few bits of information, and PolicyGenius recommends health insurance plans for that individual -- all delivered through a seamless digital experience.

2. Analysis Tools for the Small Group Market

Certain broker-facing platforms are starting to build analytical tools that help strengthen group health plan recommendations. These tools allow platforms to compare and contrast different health plans, including each plan’s network, aiding in disruption analysis and delivering value to their employer customers.

3. In-Network Provider Search and Notification Features

Many health insurtech platforms offer customers provider-network search and notification features. Stroll Health, for example, delivers personal recommendations for imaging centers based on a patient’s insurance plan. And some HR and benefits administration platforms now have the ability to notify employees if an employee’s preferred doctor drops out of network. Thoughtful features like these save consumers time and money.

See also: Next Step: Merging Big Data and AI

Why is the data so crucial?

While data may not be the sexiest element of a tech platform, the data layer enables all features. For example, for those broker-facing analysis tools to be useful, the broker platform must have access to accurate and timely data on the benefits and rates of every health plan they’ll compare. For an HR and benefits administration platform to alert an employee when a doctor drops out of network, the platform must first know when that doctor drops out of network. This means the platform must have access to an accurate and extremely granular database of providers in the specific network being tracked. Quality data is what informs today’s innovators, pushing them to take action and build exciting applications that solve real problems.

Health is a complex space, but there are many brilliant minds working to improve the health insurance industry. Putting the right data into the hands of these innovators allows them to do what they do best -- solve problems with creative technology solutions. Continuing to do this will allow today’s innovators to respond to consumer pain points and transform the health insurance industry.

These companies are finding different ways to meet consumer demands and remove the complexity associated with the insurance industry. The companies included in the healthcare segment of this infographic are, for the most part, delivering new ways to help consumers find, buy and receive health insurance. Collectively, health insurtech platforms answer a consumer cry for help. But none of these platforms are functional, let alone useful, without a foundational layer of quality data on which to build.

What are the innovators creating?

Health insurtech innovators are working to answer a variety of consumer demands. They’re creating tools that simplify the health insurance shopping experience. Tools that help doctors find prescription drugs that are covered by a patient’s insurance plan. Tools that help consumers find doctors that are in-network. The problems that these platforms solve are many.

Here are just a few examples of innovative tools and features being created to deliver value to health insurance consumers:

1. Decision Support Tools for the Individual Market

A variety of web-based entities (WBEs) have popped up to help individual consumers find and purchase a health insurance plan that is right for them. PolicyGenius is a good example of an innovative platform doing just that. The company prides itself on delivering simple benefits that are personally designed for the individual. A consumer enters a few bits of information, and PolicyGenius recommends health insurance plans for that individual -- all delivered through a seamless digital experience.

2. Analysis Tools for the Small Group Market

Certain broker-facing platforms are starting to build analytical tools that help strengthen group health plan recommendations. These tools allow platforms to compare and contrast different health plans, including each plan’s network, aiding in disruption analysis and delivering value to their employer customers.

3. In-Network Provider Search and Notification Features

Many health insurtech platforms offer customers provider-network search and notification features. Stroll Health, for example, delivers personal recommendations for imaging centers based on a patient’s insurance plan. And some HR and benefits administration platforms now have the ability to notify employees if an employee’s preferred doctor drops out of network. Thoughtful features like these save consumers time and money.

See also: Next Step: Merging Big Data and AI

Why is the data so crucial?

While data may not be the sexiest element of a tech platform, the data layer enables all features. For example, for those broker-facing analysis tools to be useful, the broker platform must have access to accurate and timely data on the benefits and rates of every health plan they’ll compare. For an HR and benefits administration platform to alert an employee when a doctor drops out of network, the platform must first know when that doctor drops out of network. This means the platform must have access to an accurate and extremely granular database of providers in the specific network being tracked. Quality data is what informs today’s innovators, pushing them to take action and build exciting applications that solve real problems.

Health is a complex space, but there are many brilliant minds working to improve the health insurance industry. Putting the right data into the hands of these innovators allows them to do what they do best -- solve problems with creative technology solutions. Continuing to do this will allow today’s innovators to respond to consumer pain points and transform the health insurance industry.