KEY TAKEAWAYS:

--Generative AI can improve auto insurers' claims processes, optimize customer interactions and recommend plan changes.

--Some companies are slow to adopt because of inaccuracies and bias issues, privacy challenges, intellectual property concerns and heightened regulatory scrutiny.

--Like any new technology, generative AI needs effective guardrails. Once the right procedures are in place, it can provide value across the customer lifecycle for auto insurance companies.

----------

As an insurance professional, you’ve likely watched the rise of generative AI. But has your employer taken advantage of generative AI yet? If not, maybe they should be.

Although auto insurance professionals have used AI for decades — particularly in the form of machine learning and predictive modeling — generative AI is a new frontier. By creating original content using patterns from existing data sources, generative AI tools like ChatGPT and Bard offer endless applications for auto insurance professionals. Used effectively, generative AI tools can help auto insurers create highly personalized programs that cater to customers’ unique needs, building stronger relationships and increasing efficiency in the handling of common tasks.

But as with other emerging technology solutions, adoption of generative AI isn’t a linear path.

The concerns about potential inaccuracies and imaginative limitations in using these tools are causing decision-makers at auto insurance companies to hesitate to fully embrace the technology.

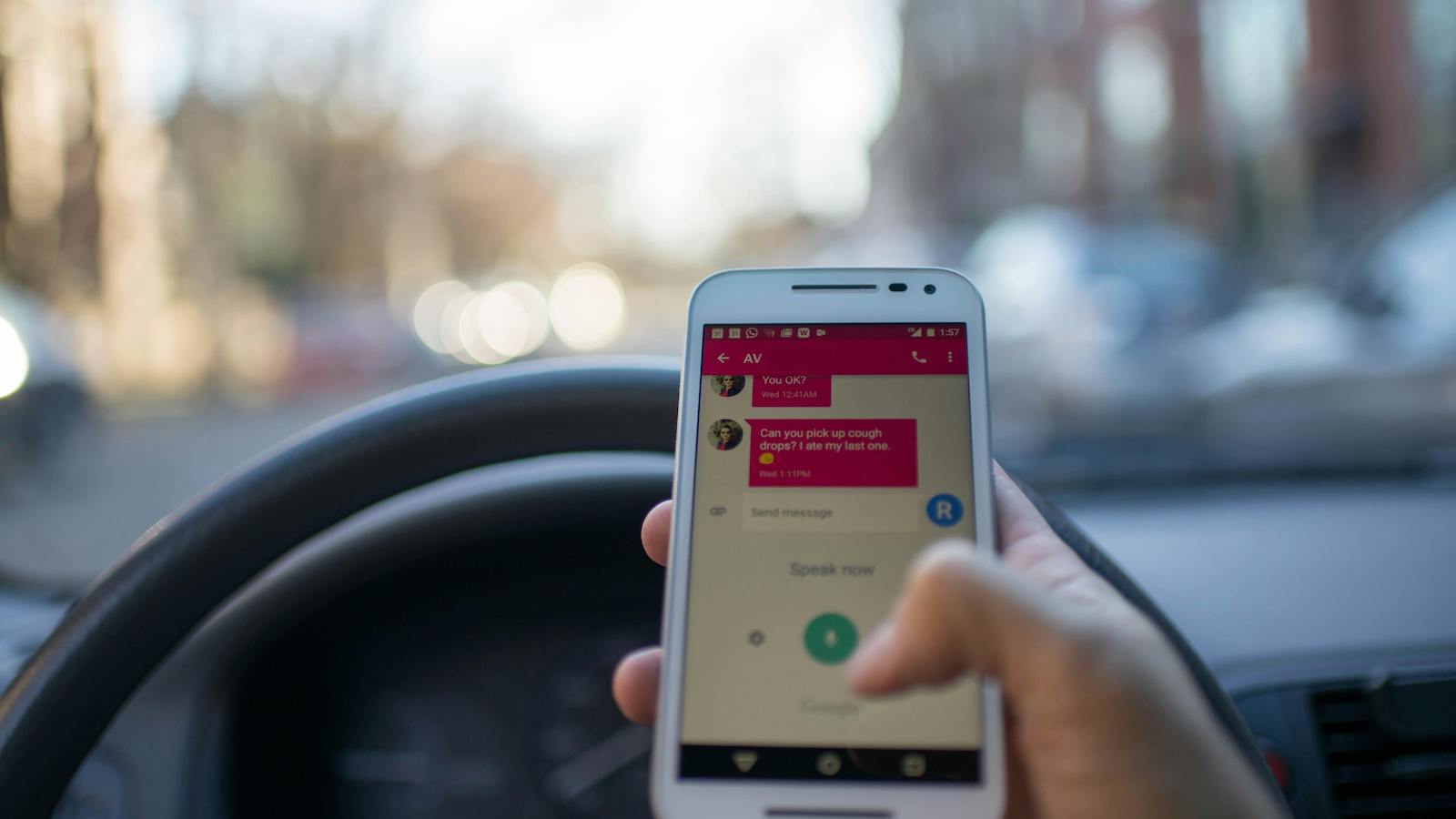

Ultimately, ChatGPT is like a driver-assisted autonomous vehicle. It requires a driver willing to invest in its possibilities of efficiency and personalization, unafraid to sit at the forefront of technology innovation. At the same time, however, these tools also require a driver who is prepared to assess outputs and intervene when necessary — a human at the wheel of a new technology always performs better than the technology on its own.

Why generative AI is worth your effort: Optimizing the customer lifecycle

So far, auto insurance companies have only scratched the surface of generative AI’s potential. Even industry leaders that have already started using generative AI can benefit from being more open-minded and creative about how they can use technology to improve future operations.

For example, generative AI tools can create automation and back office efficiencies by summarizing and synthesizing common insurance content and data. You can use these capabilities to speed up marketing content delivery, code generation, training and other documentation resources.

However, generative AI’s true power lies in its ability to deliver value to your customers — helping improve your customer experience, as well as your acquisition and retention metrics.

When you layer generative AI into your customer interactions, you can:

- Improve claims processes: Generative AI can streamline your customer claims process by extracting and categorizing information from claim documents and other data sources, such as driving data before and after a crash. While this process might require customized generative AI models, the investment can be worthwhile because of the volumes of unstructured claims data insurance adjusters must manually organize. Beyond organizing this claim information more quickly and effectively, you can also use generative AI to personalize messages based on the claims information customers provide. This is a win-win: The technology improves the customer experience, reduces the claims adjudication cycle time and enhances your brand reputation.

- Optimize customer service interactions: By combining a generative AI virtual assistant with insights about your drivers, you enable more personalized, efficient customer interactions. For example, a generative AI chatbot can automate contact center interactions based on information about your customers’ needs, driving behavior and coverage, providing customers with relevant, personalized answers and information — and saving you time.

- Recommend plan coverages: Coverage selection can be an overwhelming experience for auto insurance shoppers. Generative AI helps you analyze customer information and driving data to generate personalized insurance policy recommendations and accelerate the selling process with increased bind rates. The result? You simplify shopping experiences and allow consumers to pay for what they need, using generative AI to personalize suggestions with a customer’s unique needs, lifestyle and risk profile at the center.

While these are three prominent use cases, there are many more applications of generative AI, including risk assessment, fraud detection, trend prediction and modeling.

What’s preventing auto insurance companies from fully embracing generative AI?

If generative AI boasts these benefits for auto insurers, why has industry adoption been slow?

Risk aversion, regulatory issues, competing priorities and the novelty of generative AI have all prevented auto insurance companies from incorporating generative AI solutions in their marketing, claims and sales efforts. For starters, a lack of understanding among decision-makers and an absence of in-house generative AI expertise may prevent many businesses from taking advantage of the technology.

And like many other white-collar workers, auto insurer employees may worry about losing their jobs to automation. As a result, they may hesitate to rely on generative AI solutions. It’s important to remember that generative AI tools are still nascent technology. So, it’s understandable that auto insurance employees are risk averse toward the technology and haven’t yet taken advantage of it in their work. At the same time, it’s important to remember that AI can augment an employee’s tasks without fully replacing their entire position — these technologies need a human at the wheel.

Leadership teams at auto insurance companies must be prepared to address the concerns that have arisen around the use of generative AI tools. Although one in six Americans have used generative AI, most view AI unfavorably, leading to the distrust of tools like ChatGPT. Some of the skepticism about generative AI in insurance is justified because it can introduce biases, inaccuracies ,and security risks. Commonly cited risks include:

- Inaccuracy, ethics and bias issues: Generative AI models are only as accurate as the data they’ve been trained on and some can “hallucinate” inaccurate information. Left unchecked, generative AI models may reference and even propagate offensive and controversial content. As state legislatures move to ban the use of credit-based scoring algorithms and auto insurers work to combat bias in the quoting process, decision-makers at auto insurance companies will need to remain vigilant about this tendency when bringing on generative AI solutions, offering clear guidelines and best practices to employees.

- Privacy, security and confidentiality challenges: Your generative AI technology vendor may store user data after intake, which can lead to hacks, leaked information or personal details accidentally being made public. This presents a risk to auto insurance companies that hold sensitive personal data about drivers.

- Intellectual property concerns: Generative AI tools may produce computer code and other work not protectable by your existing IP rights, such as copyrights and patents.

- Heightened regulatory scrutiny: As more auto insurance companies take advantage of AI, the NAIC is monitoring its usage and considering regulations.

These risks may sound overwhelming at first. However, delaying adoption can increase distrust and cause businesses to fall further behind. Companies that shy away from generative AI tools now might trail competitors using these tools to reduce expenses and improve customer experiences. So it’s best for leadership teams at auto insurance companies to focus on adapting to these tools now by investing in reskilling and retraining while setting up the right guardrails and security measures.

Take full advantage of AI with a governance strategy

To address generative AI concerns and take advantage of its benefits, your organization can start small with clear guardrails and then adopt and mature a governance strategy. From there, you can monitor regulatory changes, collect employee and customer feedback and use any early learnings to inform and shape your strategy over time.

Regardless of your strategy, human involvement and oversight are critical as your organization adopts generative AI. Your teams should carefully review inputs and outputs for accuracy, fairness and bias. You’re more likely to generate usable results from a generative AI tool if the input is accurate — like real driving data — or if your data is peer-validated. While it might be easier said than done given the potential scope of inputs and outputs found across insurance spaces, it’s worth the effort.

Likewise, when consumers know exactly how and when their data is being used and how it benefits them, carriers can more effectively use data to create personalized auto insurance programs. Transparency around data usage and human involvement in generative AI benefits everyone involved.

The takeaway: Like any new technology, generative AI needs effective guardrails. Once the right procedures are in place, it can provide value across the customer lifecycle for auto insurance companies.

With these wheels, generative AI gets you where you want to go

Your imagination is the limit when it comes to generative AI, which can be both an opportunity and a hindrance.

If your business opts to invest in generative AI, you have the power to define how to responsibly use generative AI tools to improve experiences for your customers, provide increased business value and offer more efficient processes to employees. But the process starts with making sure you have the right inputs, like accurate and timely driving data, and ensuring you have guardrails in place.

Dream big and make sure a driver is always behind the wheel of your generative AI technology.