As the insurance industry undergoes a massive digital disruption, it creates a sense of urgency and forces insurers to face risks and challenges, including the increasingly complex nature of processes and operations, the rapid evolution of technology and an increase in fraud. Concurrently, the data sets collected by insurers have practically exploded in terms of volume, speed, format, accuracy—and the value they can bring to those companies that know how to harvest it.

Given the exponential pace of change, insurance leaders need to understand the implications of these trends, especially from a data and AI perspective, and consider carefully how they should respond. Augmented intelligence is changing the paradigm, helping insurance companies evolve processes, cut costs and improve customer experience with faster insights.

The Age of ‘Augmented Insurance'

To keep pace with the disruptions, insurance organizations keep evolving their distribution strategies, explore new partnerships, alter their products and transform how they use technology to deliver upon their strategy--all based on data and analytics insights. Many insurance companies already use predictive analytics to anticipate possible future customer behavior (including risk of cancellation), identify fraud risks, triage claims, anticipate trends and predict prices. But all this has required significant investment in sophisticated tools, technologies, infrastructure and--most importantly--people. Fully automated processes may work to speed up operational activities, but strategic thinking has required insights that are curated, contextual and trustworthy. Augmented intelligence breaks this dependency on manual intervention for curating deep, advanced and contextual insights.

The principle behind augmented intelligence is to act as a force multiplier to human intelligence, autonomously managing complex data processing and analytical tasks, enabling businesses to make faster and smarter decisions. As a result, it allows data scientists and analysts to focus on solving blue sky queries and data science projects and removing the burden of ad-hoc insight and narrative generation.

The AI Imperative for Insurers

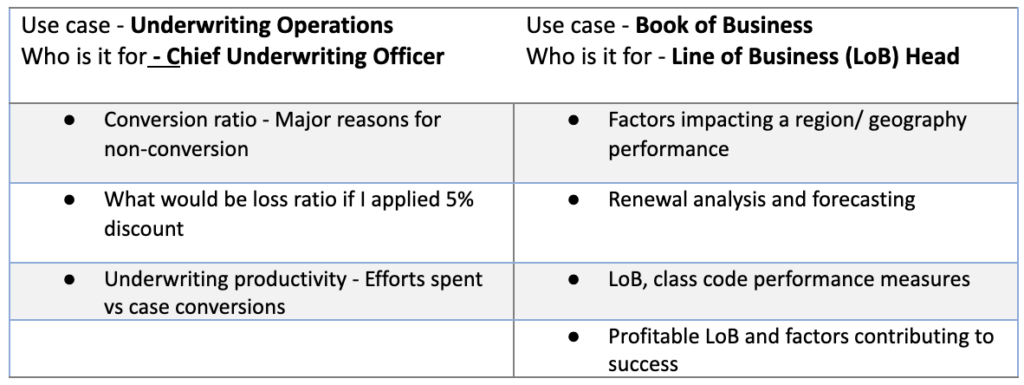

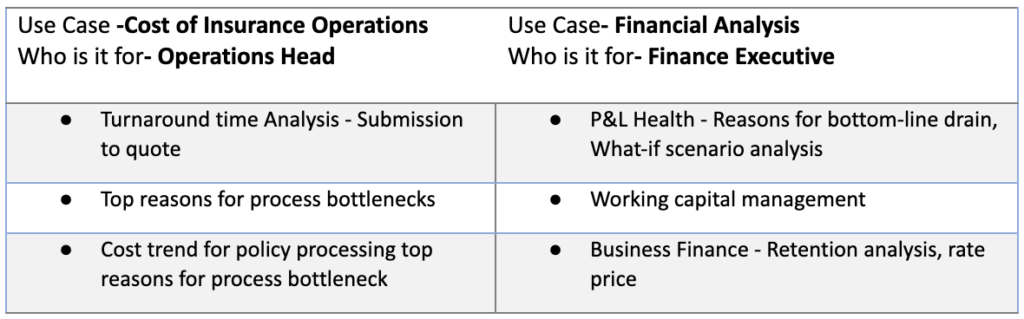

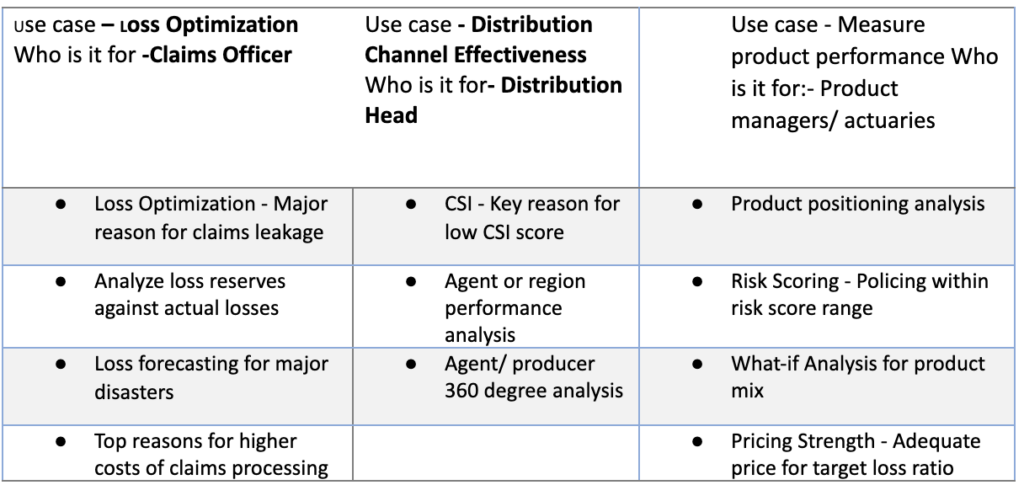

Insurers today are compelled by their existing and emerging competitors to deliver new offerings to better meet consumer needs and preferences. Recent advances in artificial intelligence, machine learning and augmented intelligence have vastly changed the analytic landscape by removing long-entrenched barriers and making advanced analytics platforms much more accessible to insurers. These new platforms have made it possible for key stakeholders such as underwriters, agents and claims adjudicators to get answers to complex business questions--like why did my claims revenue fall? or what will happen if I increase my underwriter margin by x%? and to make informed decisions based on the answers.

Whether the goal is to maximize market share, increase profitability, optimize cost--or some combination of these--insurance stakeholders require a multipronged strategy and actionable insights to achieve their objectives. They should be able to:

- Analyze key signals and performance trends from various business divisions in real time.

- Perform root-cause analysis to arrive at key measures that affect performance and understand why and how performance can be improved.

- Run multiple scenarios by changing the key inputs and impact on the targeted key performance indicator (KPI) and select the optimized strategy based on it.

- Design the next-best-move-based cognitive recommendations that take both internal and external factors into consideration.

Augmented intelligence uses machine learning algorithms to automate data and analytics processes, significantly reducing the time-consuming exploration, explanation, prediction and prescription analytics processes, as well as contextualizing the insights to user personas – we are talking about cutting down weeks of turnaround time across several decision support analysts, to near real time and no analyst intervention. Products that truly support advanced augmented analytics capabilities deliver on the promise of comprehensiveness and depth of insights across the value chain at the speed at which the business needs them; and because these are smart products they also overcome the challenges related to low adoption of analytics with a self-service enriched, personalized experience for the end user.

See also: A New Burst for Augmented Reality

Solving for Various Personas

1. Maximize Productivity

2. Reduce Costs

3. Optimize Business Processes

Checklist for Augmented Intelligence Implementation

When implementing an augmented intelligence initiative, insurers must think in terms of the full scope and implications for the organization. A few caveats to consider before going full steam on augmented intelligence strategy are:

1. Identify the relevant use cases to experiment — Augmented intelligence tools should ideally increase the breadth of analytics capabilities available to end users--which means use cases should be prioritized keeping this goal in mind. Additionally, rather than conducting use case discovery workshops with IT and business intelligence stakeholders alone, ensure the involvement of functional business leaders at the very onset to capture the specific business needs. This will result in smooth implementation processes as well as high adoption rates across functional roles.

2. Take stock of your use case data and infrastructure — While data is the common denominator for any successful artificial intelligence program, you also need to ensure your data has the relevant measures or drivers to run advanced analytics models. For example, if you do not account for drivers and causal factors in your claims data, the augmented analytics tool will not be able to explain the phenomena driving the changes. Additionally, augmented analytics projects require infrastructure that can support large data sets and run millions of queries and advanced machine learning models in seconds. Whether on premises or on cloud, always consider the data needs and infrastructure requirements. Ensure they are in line with the identified use cases so as not to compromise on the solution’s efficiency or speed of delivering insights.

3. Orchestrate with existing BI applications — As the name suggests, augmented intelligence "augments" the potential of your existing analytic and insights assets. Don’t consider it as a replacement to your existing dashboards or BI tools. Choose a solution that can seamlessly blend with their existing architecture and doesn’t require heavy architectural modifications.

4. Select the right augmented intelligence partner — Your success with augmented intelligence depends on who you entrust it with to take it to the finish line. Having the relevant capabilities that can support the varied requirements as well as devise ways to overcome the common adoption hurdles associated with analytics tools is critical. Moreover, if the vendor doesn't have a road map on how to further develop the product, or have a support team of domain experts that can help you design new use cases, chances are your experiment will meet a pre-mature death.

See also: Untapped Potential of Artificial Intelligence

Conclusion

The ability to rapidly respond to an uncertain environment is expected to become a new core competency. Augmented analytics should be viewed as an always-on, immersive system that guides key stakeholders and provides visibility for lines of business, teams and locations. Insurers need to graduate employees from tedious manual processes, focusing their efforts on decision-making that adds business value instead. Insurers need to think about how augmented intelligence can become a key enabler of strategic choices, and not a barrier to success.