Hiring incompetent producers is apparently the strategy of a group of agency owners who told me that my advice that no producer is better than a bad producer was:

- Just wrong

- Too harsh

- Short-sighted

I have seen some consultants make the same case, so I thought I should have an open mind and reconsider my position.

The consultants’ point was that every commission dollar sold is worth (pick a multiple) 1.3 or 1.5 or 2.0 times. That makes every commission dollar a commodity. From the agency owners’ perspective, one way to build value is to put as many commission dollars on the books as possible because the value is same regardless of whether the sales are profitable or unprofitable. The value is not affected by whether the sales are personal lines or commercial, whether the accounts carry more or less E&O risk. All sales carry the same value, in this perspective.

Some people will argue I have taken the consultants’ and agency owners’ point too far, but that is impossible. Remember, their point was that poor producers, meaning unprofitable producers, still have enough value to justify keeping them. This means that even if the producers’ sales have a negative 20% profit margin, which is common, the consultants and agency owners believe these sales have the same effective value as books of business with a 20% profit margin.

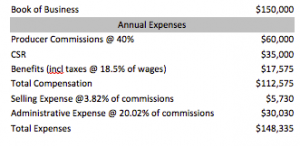

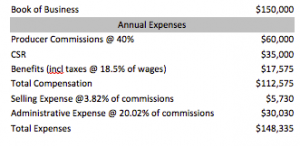

The strategy of adding sales without regard to profitability is quite relevant if the agency can grow fast enough and sell itself quickly enough. More than one such flip has made an agency owner wealthy. The key is how long the producer is with the agency before the sale. Let’s say that at the end of five years a producer has generated $150,000 of commissions. The profit on this book is (using industry standards for agencies with $1 million to $2 million in revenue):

This excludes all administrative wages such as the bookkeeper, receptionist, claims and so forth. It excludes ANY owner compensation. It understates the CSR compensation, too, because the average commercial CSR makes much more than $35,000. If we include these real additional expenses proportionately, this book likely is still losing money in the fifth year, anywhere from $10,000 to $30,000. Losses in the prior years were even greater as the book was built.

Over five years, then, the agency has likely lost between $75,000 and $150,000 net. Using $75,000 and a one-times multiple and an agency sale in year five, the agency still nets $75,000 (($150,000 times 1.0) - $75,000) = $75,000.

But if the agency hangs on too long or the five-year loss is too great, this strategy fizzles. So to make this work financially, the agency owner has to have a firm and fast exit plan.

Why not hire quality producers initially? Then the agency gets profit and value simultaneously. Besides, who in their right mind would pay the same multiple for an unprofitable book as for a profitable book? Let’s use an EBITDA example. If the profit is $25,000 and the EBITDA multiple is six, then the value is $150,000. What is the value of a book with a loss of $25,000 and a multiple of six times?

Why would someone pay the same multiple for a low-profit book as for a high-profit book? Maybe the thought is that books all average out. But why do they have to average out?

A poor producer cannot take an entire book, even most of a book, with him if fired. If the producers were so good, they would not have been fired. So agency owners can eliminate unprofitable producers and reassign their books to staff or other producers at lower commission rates, which is common when books are transferred between producers. This is a key secret to the success some serial acquirers have achieved. They completely understand that poor producers are unnecessary so when they buy, they fire and they keep the business but make it profitable. Even if 20% is lost, that is 20% losing money vs. 80% making money.

I truly feel for agency owners struggling to find quality producers. If it was easy, everyone would do it. Is hiring poor producers really the solution, though?

My experience, and I’ve seen the hard data, is that when agency owners properly prepare their agencies for finding quality producers, use the right interviewing tools and tests and create a quality development/management plan, successful hire percentages quadruple. All the work -- and it is a lot of work -- is before the hire, and, given all that agency owners already have to do, finding the time and energy for this key element is not so easy, but it is essential if the goal is to truly build profit and value.

This excludes all administrative wages such as the bookkeeper, receptionist, claims and so forth. It excludes ANY owner compensation. It understates the CSR compensation, too, because the average commercial CSR makes much more than $35,000. If we include these real additional expenses proportionately, this book likely is still losing money in the fifth year, anywhere from $10,000 to $30,000. Losses in the prior years were even greater as the book was built.

Over five years, then, the agency has likely lost between $75,000 and $150,000 net. Using $75,000 and a one-times multiple and an agency sale in year five, the agency still nets $75,000 (($150,000 times 1.0) - $75,000) = $75,000.

But if the agency hangs on too long or the five-year loss is too great, this strategy fizzles. So to make this work financially, the agency owner has to have a firm and fast exit plan.

Why not hire quality producers initially? Then the agency gets profit and value simultaneously. Besides, who in their right mind would pay the same multiple for an unprofitable book as for a profitable book? Let’s use an EBITDA example. If the profit is $25,000 and the EBITDA multiple is six, then the value is $150,000. What is the value of a book with a loss of $25,000 and a multiple of six times?

Why would someone pay the same multiple for a low-profit book as for a high-profit book? Maybe the thought is that books all average out. But why do they have to average out?

A poor producer cannot take an entire book, even most of a book, with him if fired. If the producers were so good, they would not have been fired. So agency owners can eliminate unprofitable producers and reassign their books to staff or other producers at lower commission rates, which is common when books are transferred between producers. This is a key secret to the success some serial acquirers have achieved. They completely understand that poor producers are unnecessary so when they buy, they fire and they keep the business but make it profitable. Even if 20% is lost, that is 20% losing money vs. 80% making money.

I truly feel for agency owners struggling to find quality producers. If it was easy, everyone would do it. Is hiring poor producers really the solution, though?

My experience, and I’ve seen the hard data, is that when agency owners properly prepare their agencies for finding quality producers, use the right interviewing tools and tests and create a quality development/management plan, successful hire percentages quadruple. All the work -- and it is a lot of work -- is before the hire, and, given all that agency owners already have to do, finding the time and energy for this key element is not so easy, but it is essential if the goal is to truly build profit and value.

This excludes all administrative wages such as the bookkeeper, receptionist, claims and so forth. It excludes ANY owner compensation. It understates the CSR compensation, too, because the average commercial CSR makes much more than $35,000. If we include these real additional expenses proportionately, this book likely is still losing money in the fifth year, anywhere from $10,000 to $30,000. Losses in the prior years were even greater as the book was built.

Over five years, then, the agency has likely lost between $75,000 and $150,000 net. Using $75,000 and a one-times multiple and an agency sale in year five, the agency still nets $75,000 (($150,000 times 1.0) - $75,000) = $75,000.

But if the agency hangs on too long or the five-year loss is too great, this strategy fizzles. So to make this work financially, the agency owner has to have a firm and fast exit plan.

Why not hire quality producers initially? Then the agency gets profit and value simultaneously. Besides, who in their right mind would pay the same multiple for an unprofitable book as for a profitable book? Let’s use an EBITDA example. If the profit is $25,000 and the EBITDA multiple is six, then the value is $150,000. What is the value of a book with a loss of $25,000 and a multiple of six times?

Why would someone pay the same multiple for a low-profit book as for a high-profit book? Maybe the thought is that books all average out. But why do they have to average out?

A poor producer cannot take an entire book, even most of a book, with him if fired. If the producers were so good, they would not have been fired. So agency owners can eliminate unprofitable producers and reassign their books to staff or other producers at lower commission rates, which is common when books are transferred between producers. This is a key secret to the success some serial acquirers have achieved. They completely understand that poor producers are unnecessary so when they buy, they fire and they keep the business but make it profitable. Even if 20% is lost, that is 20% losing money vs. 80% making money.

I truly feel for agency owners struggling to find quality producers. If it was easy, everyone would do it. Is hiring poor producers really the solution, though?

My experience, and I’ve seen the hard data, is that when agency owners properly prepare their agencies for finding quality producers, use the right interviewing tools and tests and create a quality development/management plan, successful hire percentages quadruple. All the work -- and it is a lot of work -- is before the hire, and, given all that agency owners already have to do, finding the time and energy for this key element is not so easy, but it is essential if the goal is to truly build profit and value.