Six years ago, my friend Adrian Jones and I published our first deep analysis of the iconic full-stack insurtech carriers (Lemonade, Root and Metromile). Our "Five Dispatches from Insurtech Survival Island" found:

- Underwriting results have been poor

- It costs $15 million a year to run a start-up insurtech carrier

- Customer acquisition costs and back-office expenses (so far) matter more than efficiencies from digitization and the absence of legacy systems

- Reinsurers are supporting insurtech by losing money, too

- In recent history, the startup insurers that have won were active in markets not targeted by incumbents

Personal note: I really miss that 2018 collaboration with Adrian to review the insurtech facts and figures. A week of back-and-forth, integrating the different perspectives and challenging each other, allowed us to extract the best from our accumulated knowledge. Moreover, his analytical rigor and exposure elegance made the first chapters the most precious gems of this six-year-long series. However, it is what it is. I'm continuing to report here my perspective on the insurtech facts and figures. It is an unpolished and instant snapshot of my perspective, written by carving out a few hours on an overnight intercontinental flight. I'm trying to write something interesting each month... but available time and inspiration allows me to do it just eight or nine times a year. I do my best, hope you like it.

In the past months, the current full-stack insurtech trio (Lemonade, Root and Hippo) published their 2023 results, and they were not so bad. The dispatch from Survivor Island says: We are alive, and we may survive! (Metromile, one of the original castaways, didn't and was acquired by Lemonade a couple of years ago.)

Sse also: Tech Secret to a Combined Ratio Below 100%

Let's look at some of the main pieces of evidence from this dispatch:

- It costs $1 billion to $2 billion to build an insurtech carrier that barely enters the top 30 in personal auto or homeowners

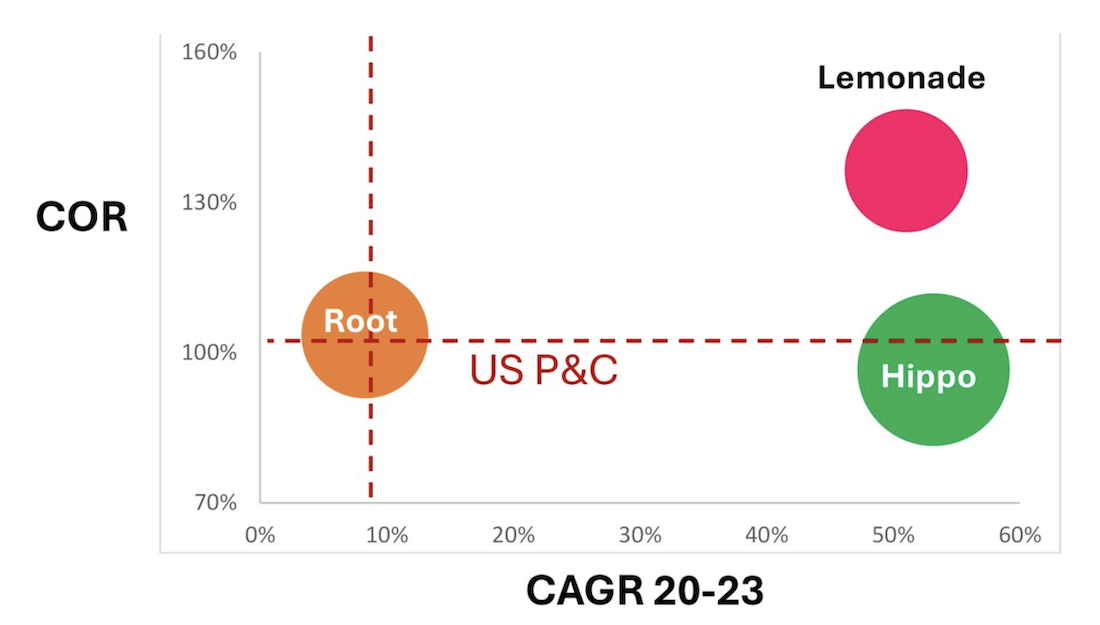

- Underwriting results have improved but are still poor

- The carriers are still not efficient

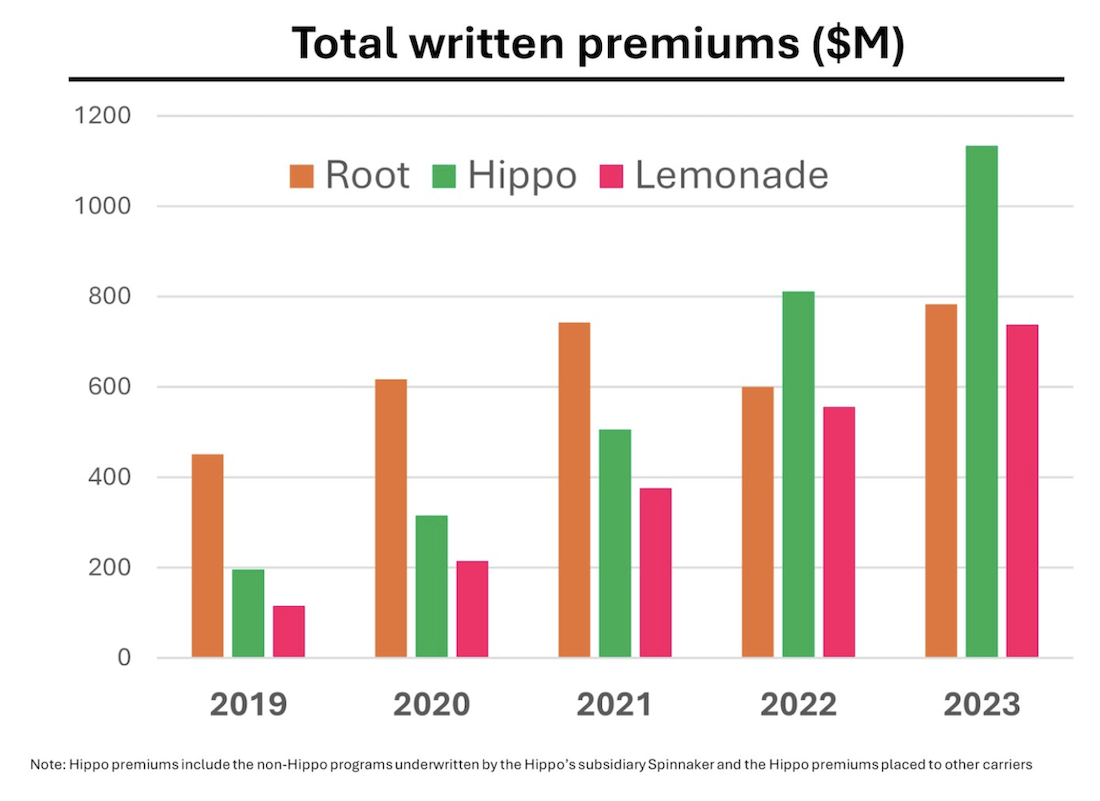

- Root burned $1.7 billion to build an auto business of almost $800 million in premiums. (The U.S. auto market was $316 billion in 2023, with the 25th player writing $1.3 billion.) The company grew until 2021, shrank in 2022 and rebounded last year. A non-immaterial part of its business comes from embedded insurance.

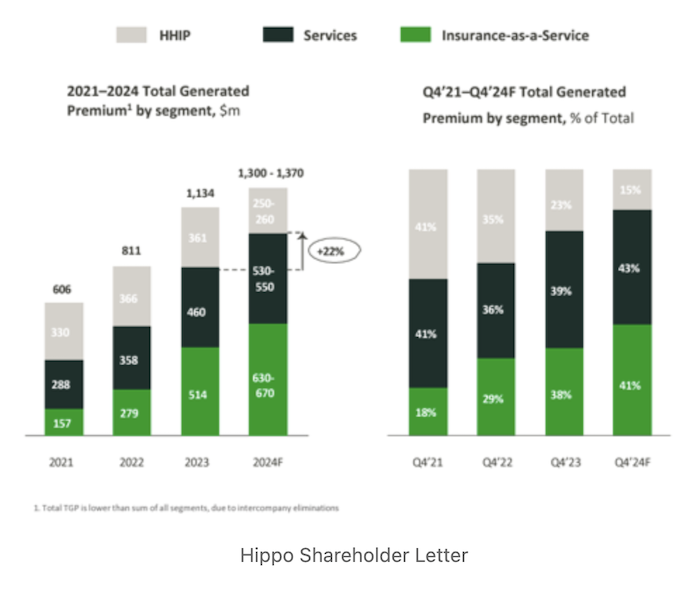

- Hippo burned $1.2 billion to build an insurance business of $1.1 billion in premiums. An MGA back in the day, Hippo has acquired a carrier that gives underwriting capacity to MGAs (IAAS in the figure below) and is acting also as an agency selling third-party policies (services in the figure below). Without the agency premiums, the written premiums are $800 million. Hippo is an articulated business that has continued to grow over the years, but the original homeowner business sold and underwritten (HHIP) in the figure below) is pretty stagnant at about $300 million (U.S. homeowner multiperil was $152 billion in 2023, with the 25th player writing almost $1 billiion).

- Lemonade burned about $1.1 billion to build an insurance business of slightly more than $700 million in premiums and has reached the milestone of 2 million clients. The main line of business is homeowner multiperil, as for Hippo (but with a predominant presence of renter insurance), with about a quarter of the premiums done by the pet insurance business (inland marine) and with a limited contribution of the auto and international business. Lemonade in renter and pet insurance is probably able to show the most relevant market shares among all the businesses of the trio. Unfortunately, the segments aren't big enought to allow us to talk about any sign of disruption in the market.

See also: The 'I Told You So' Moment

Underwriting results have improved but are still poor

All these players have hired seasoned insurance executives over the years and have focused on improving technical profitability. Since the time when they were used to pay out in claims the same or even more than they’ve collected in premiums, there has been (somehow) evidence of significant improvement:

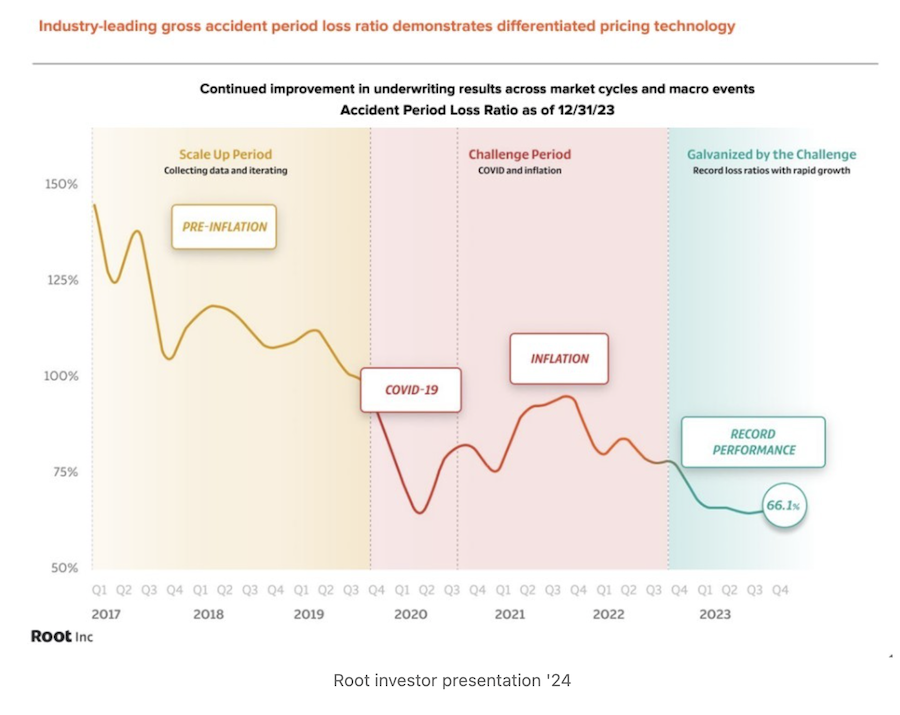

- Root has brought the loss ratio down to 76%, while the personal auto insurance sector was on average almost at 78%

- Hippo has brought the loss ratio down to 71%. However, the Hippo product (HHIP in the figure above) is still at 103% while the homeowner multiperil line '23 loss ratio was 72%. More than fixing the Hippo original homeowner product, they are writing a good business with Spinnaker as a fronting carrier for other MGAs, and this subsidizes Hippo's loss-making business.

- Lemonade has brought the loss ratio down to 85%, but that is high for homeowners insurance and extremely high for a mostly renter portfolio.

Note: All are gross loss ratios and include LAE; the Root's figure below is about loss ratio without the LAE.

Root's loss ratio is an outlier and doesn't deserve the headline "poor"; however, I've some doubts if it is more due to their underwriting performance or to the peculiar contingency of the U.S. auto insurance market. Their shareholder letter says, "We recorded an exceptional loss ratio as we benefited from our technology platform’s ability to drive pricing and underwriting improvements," and, "We are still in the early chapters of disrupting the auto insurance industry."

In 2023, large carriers in many states struggled to obtain regulatory approval for rate changes and, consequently, tightened their underwriting guidelines. It isn't unlikely a small carrier with bloody past technical results has obtained quick approval for rate changes and had room for growth (without investing too much in advertising).

Before dropping the magic world "disruption" loved by futurologists and black swan hunters, I suggest waiting a few quarters within a more stable auto insurance market landscape.

See also: Lemonade's 'Synthetic Agent' Nonsense

Still not efficient insurance carriers

All three players have cut their marketing budgets compared with what they were used to; they aren't any longer the pure and brave online direct-to-consumer players you have met at insurtech conferences with colored T-shirts. All of them are also working with independent agents and embedding insurance policies in other incidental channels. Moreover, Hippo's only profitable business is the fronting business with the policies sold by other MGAs.

They have also controlled the cost base at a decent level, all but Lemonade:

- Root: spent in marketing and sales 6% of the premiums, and its administrative costs are 22% of the written premiums;

- Hippo: spent in marketing and sales $56 million (9% of the premiums of the Hippo product and the agency), showing that selling third-party policies at least offsets part of the marketing costs. The other costs represent 17% of the premiums written (thanks to the efficiency of the fronting business);

- Lemonade spent in marketing $102 million (14% of the written premiums), and the other costs added 38 percentage points to the combined ratio.

All these businesses burned a significant amount of cash even in 2023. The cash lost in operating activities was: Root, $34 million; Hippo, $92 million;, and Lemonade, $119 million. All amounts are lower than in the previous years. In the next few days, the Q1 '24 financials will be published, and we will have an update on the trajectory.

Considering the trend of improvement and that there are still significant buffers of cash in their balance sheet, our castaways may survive.

But there is still no sign of any disruption from the island.