The past several years provide ample perspective on what it means to grow a business via social media, teaching us what works and, perhaps more importantly, what doesn’t. Early adopters are getting their social strategies down to a science; insurance companies commonly generate significant business value by enhancing existing customer relationships and expanding business through social channels.

Research shows that the initial rush to get customers to simply “like” corporate pages on Facebook was misguided––“likes” for a brand have little value when compared with interactions between agents or reps and customers on an individual level through social media. Personal interactions can lead directly to sales, whereas a “like” rarely translates to dollars. Our own data at Hearsay Social supports this. One major insurance client shared that its agents who used social media to personally connect with customers and prospects had an average of greater than 20% more sales than those who don’t. Customer retention also improves drastically.

Based on our experiences working with numerous large, multi-line companies, I want to share four simple reasons why insurers need to become “social” businesses.

You will notice that these four principles have always applied to successful agencies and businesses; the communication channels are simply evolving.

1. To get found

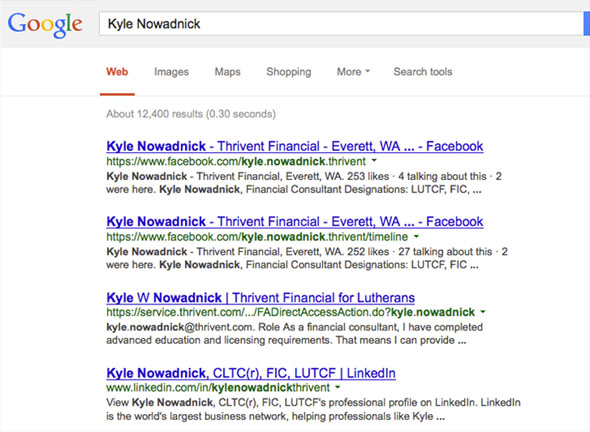

Being “findable” used to require significant up-front marketing effort and spending. Agencies often invested heavily in ads, sponsorships, and prime real estate to be discovered and considered by prospects. But the way people research has fundamentally changed. Today’s buyers go online to research products or services before purchasing. Whether people are buying a book or a complex financial product, it’s safe to assume that digital research factors into the purchase process. Today, social media is one of the most powerful ways to help an agent or business get found. If a customer searches on Google, social media pages and profiles are typically at the top of their results.

In this example, 3 of the top 4 results in a Google search for the name of a Thrivent Financial Advisor are for his social media pages, demonstrating how a social media presence greatly improves “findability.”

Additionally, with complex products like insurance or financial services, where the decision-maker relies on expert advice, they look for people whom their friends or colleagues recommend. Where one might have previously called friends and colleagues about where to take their business, people increasingly turn to social networks as the easiest way to find the right expert.

2. To grow networks

An extensive network has always been a key indicator of a good businessperson. Historically, new agents were trained to continually build and maintain strong personal networks. The same is true today, and the rise of social networks has made this entire process more efficient and powerful. Social networks online act just like shared connections in the physical world-- online social networks provide the context, familiarity, and trust that allow good sales people to effectively establish a credible rapport to represent themselves and their brand.

Building and maintaining long-term personal relationships is also essential to gaining referrals and repeat sales. On social media, this means connecting with all your friends, colleagues, and business contacts from the offline world. Successful social sales representatives then use social media to connect with customers and continually engage before, during, and after a sales cycle.

3. To “hear” customers and start meetings warm

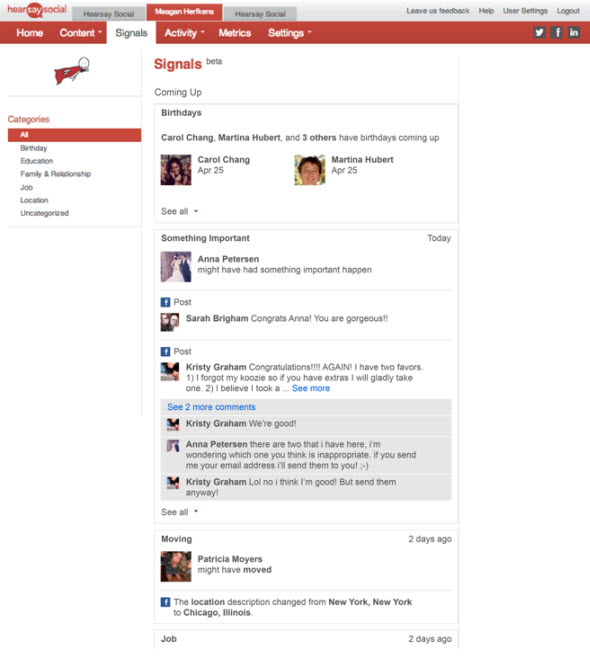

Listening to and understanding clients is a key characteristic that separates successful relationship managers from the pack. People share valuable information and buying signals on social networks, and gathering insights from posts makes it easy to identify and understand customer needs so that sales reps can truly go into meetings “warm.”

Agents and reps can “hear” what is going on in their networks with Social Signals alerts that highlight key life events, such as weddings or new babies, that could be opportunities to reach out.

Companies that embrace social business provide their teams with powerful ways to pay attention to what’s going on with customers, which increases productivity. Information shared by consumers via social networks also helps relationship managers understand the appropriate time to reach out, with exactly the right information.

4. To build credibility

In the insurance industry, customers must rely on their agent, advisor, or wholesaler as an expert. Buyers don’t have the time to do their own research and stay up-to-date. Social media makes an enormously powerful and effective tool for sales reps to demonstrate expertise and consequently build trust. Industry-leading relationship managers share content via social channels to build credibility and educate customers. In addition, sharing content on social networks helps relationship managers stay top of mind with prospects with whom they haven’t yet engaged. When the prospect is ready to move forward, they know exactly who to contact to initiate sales conversations.