Much has been written over the years about what sets great claims organizations apart from all others, but none of these analyses really apply anymore.

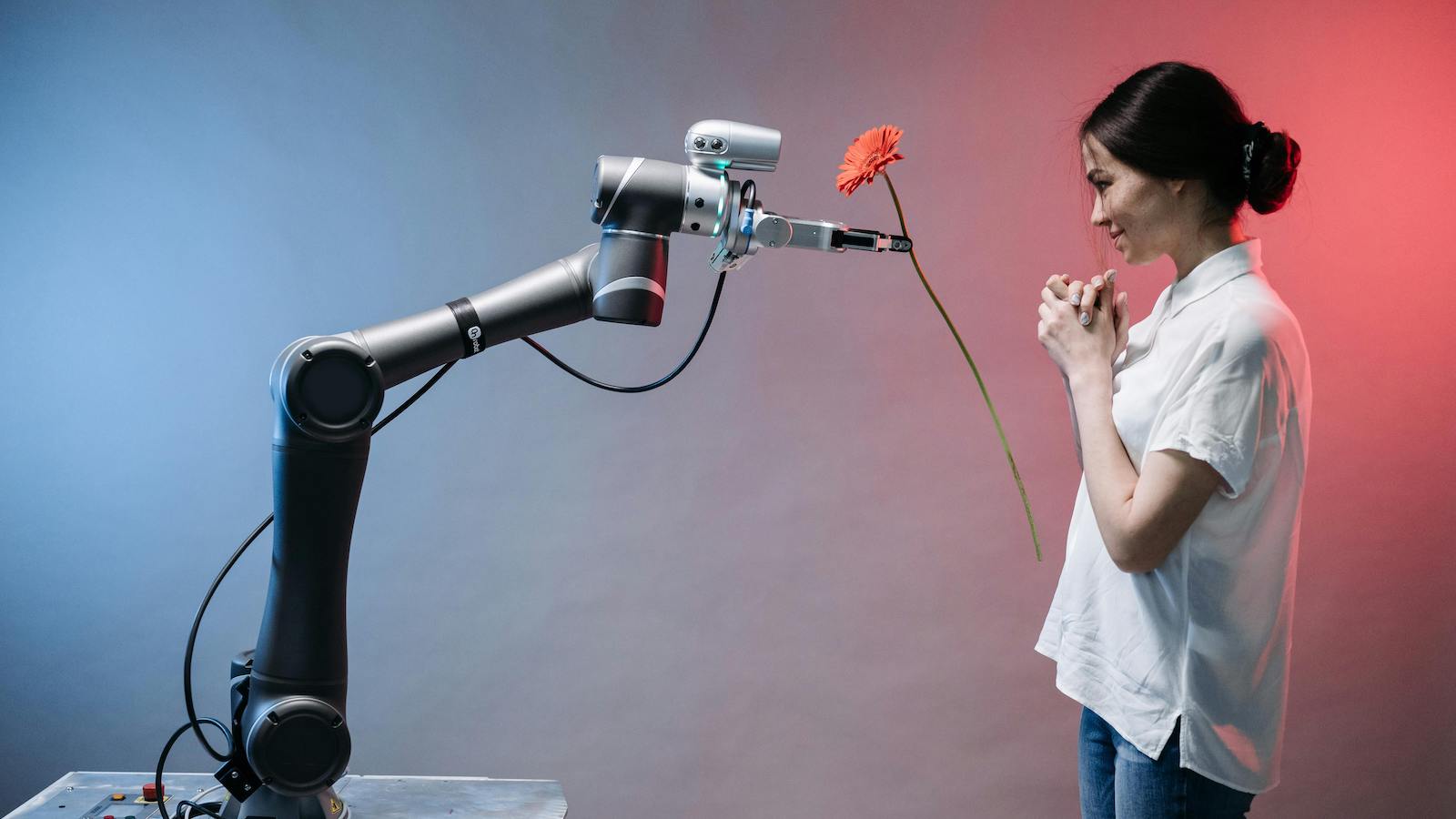

The new world in which insurance and claims now operate features totally different customer profiles, plus emerging, tech-enabled solutions that can solve challenges in the claims process that have existed for decades. Additionally, we have very different insurance products and coverage opportunities and a highly competitive business environment in which all participants are judged not just among their peers but against the most popular consumer brands across all industries globally.

Old marketing and advertising strategies are no longer relevant, as new forms of communication have emerged that influence consumer opinions and the way in which information is disseminated and consumed.

In short – the game and the rules have changed, materially and forever!

In today’s world, leadership, collaboration and partnerships have the greatest impact on the quality of the claims process and experience.

Leadership Impact

The greatest single influence over all of this is leadership, which can come from a variety of directions, but most effectively from the CEO or other C-suite leaders. This is where authority and power reside, and where company vision, mission and culture are created. It is the mission, not the perks, that attracts and motivates employees.

The most successful insurance companies are those with leaders who set and continuously articulate the corporate tone, support gender equality, diversity and inclusion, promote family culture, celebrate employee achievement and life milestones and aggressively encourage a healthy work-life balance.

See also: Future of Claims Intake for Insurance?

And today’s most successful claims operations are those in insurance companies whose leadership understands the value of and promotes collaboration and partnerships. In the new world, nothing innovative or entrepreneurial really happens without mastering this collaboration.

Leadership Support

Obvious examples of support include financial investments, budget, staffing and upskilling initiatives. In larger insurance organizations, other assistance may include inter-departmental support from IT, finance and digital and innovation teams. Alignment with legal support is also essential, especially in light of regulatory and other potential exposures when making process and consumer changes.

Perhaps less obvious, but still critical, is the creation of an environment that encourages a culture of innovation that is future-focused, one that features tolerance for mistakes with safety nets in place. This is certainly challenging for leaders who are typically balancing risk and exposure and the demands of shareholders and directors with the recognized need to innovate at an unprecedented pace.

The most successful companies have developed teams and processes to identify, engage, evaluate and partner with the best insurtech startups, which promote “test and learn” and which are able to move rapidly from piloting to implementation. Also demonstrated by these leaders is a willingness to temporarily accept imperfection and iterate to accelerate progress, which is a departure from traditional methods of elongated pilots. Being a “fast follower” and waiting for peers to succeed or fail with pilots is only a recipe to fall further behind innovators.

Positioning for Future Success

Perhaps most important of all for leaders is to provide resources to claims organizations to extensively assess the insurtech landscape for potential partners and to keep their knowledge current, because startups constantly improve their solutions.

It is imperative that this effort be a team approach, where the broader organization is involved and such learning and information is socialized, as opposed to restricted to key individuals or select innovation teams. One such approach is to measure and monitor organizational return-on-learning. In other words, in much the same way as policy coverage expertise or damage evaluation are coveted skills for adjusters and claim leadership, organizations should assess the effectiveness of sharing knowledge around automation, technology and collaboration.

See also: Avoiding the Pitfalls in Catastrophe Claims

These initiatives are neither easy nor inexpensive, and they undoubtedly require total leadership commitment, but they can turn average competitors into industry leaders and ensure longer-term success in what we all know is going to be a totally different marketplace and world.

At the Connected Claims USA conference (June 24-25, Chicago), insurance leaders and insurtech partners will be gathering to learn and form lasting partnerships that will change the game.