EY’s Global Insurance Consumer Survey reveals how insurers can support the needs of those affected by the COVID-19 pandemic.

In brief

- Insurers must evolve to meet changing consumer behaviors and priorities caused by the pandemic.

- The greatest opportunity for insurers lies with those most financially affected.

- Pervasive and contentious social issues call for insurers to engage, collaborate and lead the development of new solutions.

In late 2020, EY Insurance conducted a global survey of 2,700 consumers and 1,200 small business owners to understand how the pandemic has affected their lives. Our survey of consumers focused on their needs for personal lines and life and retirement insurance products.

To better understand the concerns and product preferences of respondents, we grouped these individuals into three segments: most financially affected, moderately affected and least affected. Across all segments, there are clear opportunities based on consumers’ shifting priorities:

- Consumers are seeking to restore their financial well-being and security, with more than half of respondents saying they plan to save more as a result of COVID-19.

- Those who experienced the greatest financial distress from the pandemic intend to minimize future financial risk and uncertainty.

- The most affected consumers are socially active and place a high value on social responsibility in their insurance purchasing decisions.

Our survey confirms what we’ve heard from senior insurance executives across the industry: This is a moment of opportunity for the industry to increase its relevancy and live its purpose by playing a critical role in the recovery of consumers and the wider economy.

To play such a role, insurers will need to develop innovative products that align to consumers’ evolving needs and provide tangible value.

How the pandemic has affected insurance consumers

Our methodology allowed us to identify the extent to which the pandemic has affected the financial state of respondents in each country. As exemplified in the chart below that displays data from our life insurance findings, there is a sizable difference in impact between those most financially affected and those least affected. For instance, 54% of the most affected experienced a loss of a regular work schedule to a great degree, and 56% lost income to a great degree. Among the least affected respondents, those figures were 0%.

While the most affected consumers are typically younger (70% are under the age of 45) and less affluent than overall respondents, they are not exclusively from these sociodemographic groups. For example, in the U.S., 56% of the most affected respondents held at least one college degree, and 40% earned over $100,000 a year.

The survey also explored respondents’ concerns for the future and their appetite for insurance products. The most and least affected reported similar concerns and insurance needs, suggesting a widespread feeling of vulnerability and anxiety in a world already defined by geopolitical tensions, growing inequality and threats from climate change.

How the pandemic is shifting preferences on protection

Finding financial well-being through cost-effective alternatives

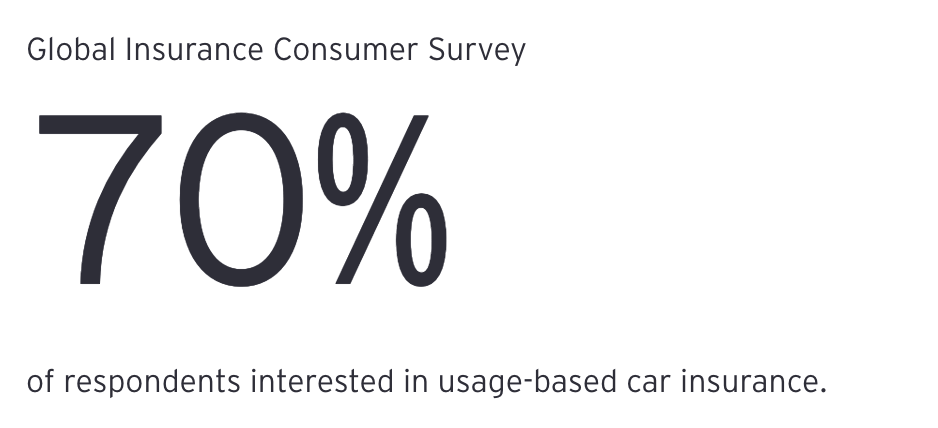

Looking at life insurance and retirement, the top concerns can be directly linked to the health and financial impacts of the pandemic: Fear of losing a loved one is by the far the greatest concern, followed by financial well-being. In seeking financial security, consumers are most interested in products that cover loss of income, credit card bills and other existing financial commitments.

Given the heightened financial anxiety and focus on financial well-being, consumers are seeking cost-effective insurance alternatives, such as policies with lower premiums. Consumers also express willingness to provide personal data or wear a fitness tracker in exchange for a discount or customized monthly rates.

See also: How COVID Alters Consumer Demands

More time at home creates new risks

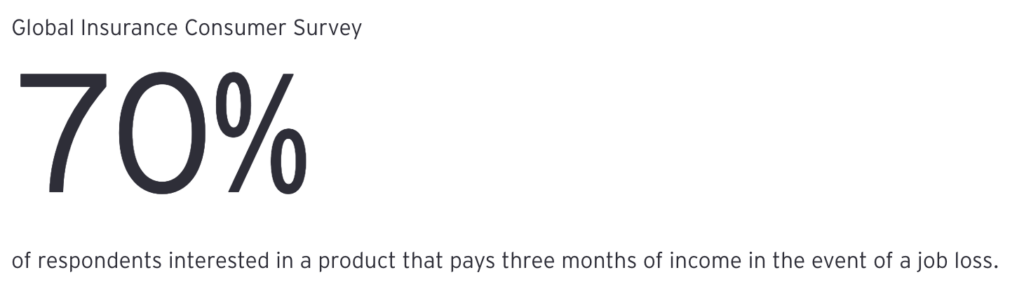

From the perspective of personal lines, behavioral change brought about by the pandemic is reflected clearly in the results. For instance, cyber fraud as a result of increased time online was the respondents’ top concern, followed by paying for insurance for a car that’s being driven less. Consumers are also more interested in usage-based insurance and home-protection products.

Given that remote working is expected to continue for many employees, insurers should develop products suited to the “new normal,” such as home-protection and usage-based policies.

What to know about those most affected

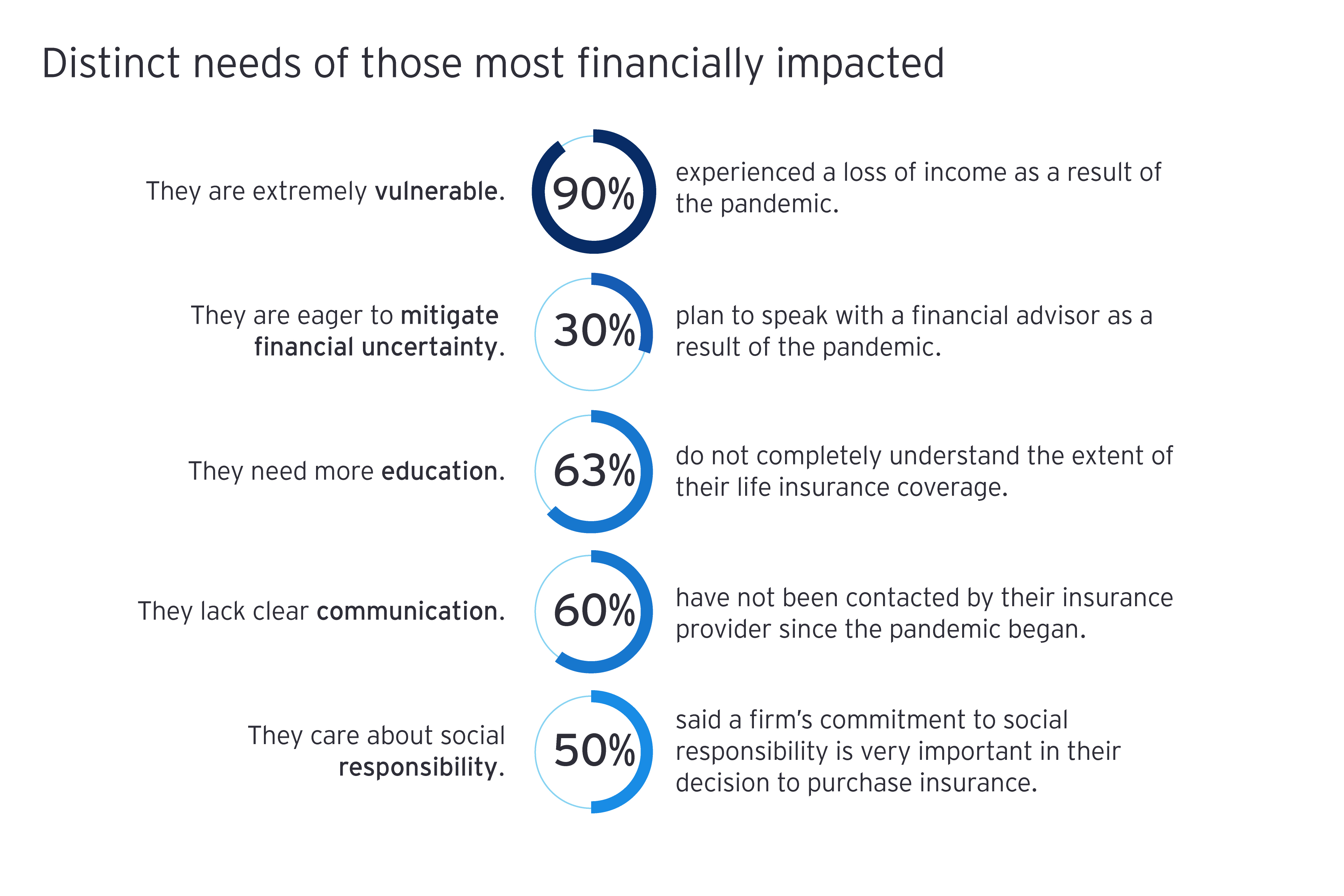

Those who have experienced the greatest financial impact are inclined to plan for future financial uncertainty: They are more likely than respondents overall to develop an emergency plan, speak with a financial adviser, increase contributions to pension and retirement accounts and purchase new forms of insurance.

Despite this group’s heightened focus on financial planning, since the onset of the pandemic, the majority (60%) of this demographic said that they have not been contacted by their insurance provider. A majority (63%) also said they do not completely understand the extent of their life insurance coverage.

Insurers that contact this demographic, communicate the value of insurance and offer protection solutions at a time of need can help this segment recover while forming the foundation for long-term customer relationships.

Why social responsibility and justice matter

The most affected consumers are both highly concerned about social justice causes and place a greater value on an insurance firm’s social responsibility efforts in their purchasing decisions.

More than half of the most affected respondents reported that a firm’s commitment to social responsibility (racial injustice, environmentalism, income equality, police brutality and employee relations) is very important in their decision to purchase insurance. In addition, the most affected were twice as likely (61%) to donate money, time or supplies to a racial justice organization since March 2020 than respondents overall (31%).

Corporate activity around social purpose is becoming increasingly important to brand reputation and customer retention — and insurers need to think differently about what they are doing in this space.

Insurers have an opportunity to engage a socially active, energized audience by amplifying their corporate social responsibility efforts, including policies and investments to promote equality, diversity and inclusion. Within executive ranks, environmental, social and corporate governance (ESG) and sustainability-related initiatives and a focus on long-term value are important to demonstrating the vital purpose of the industry.

Strategic and operational implications for insurers

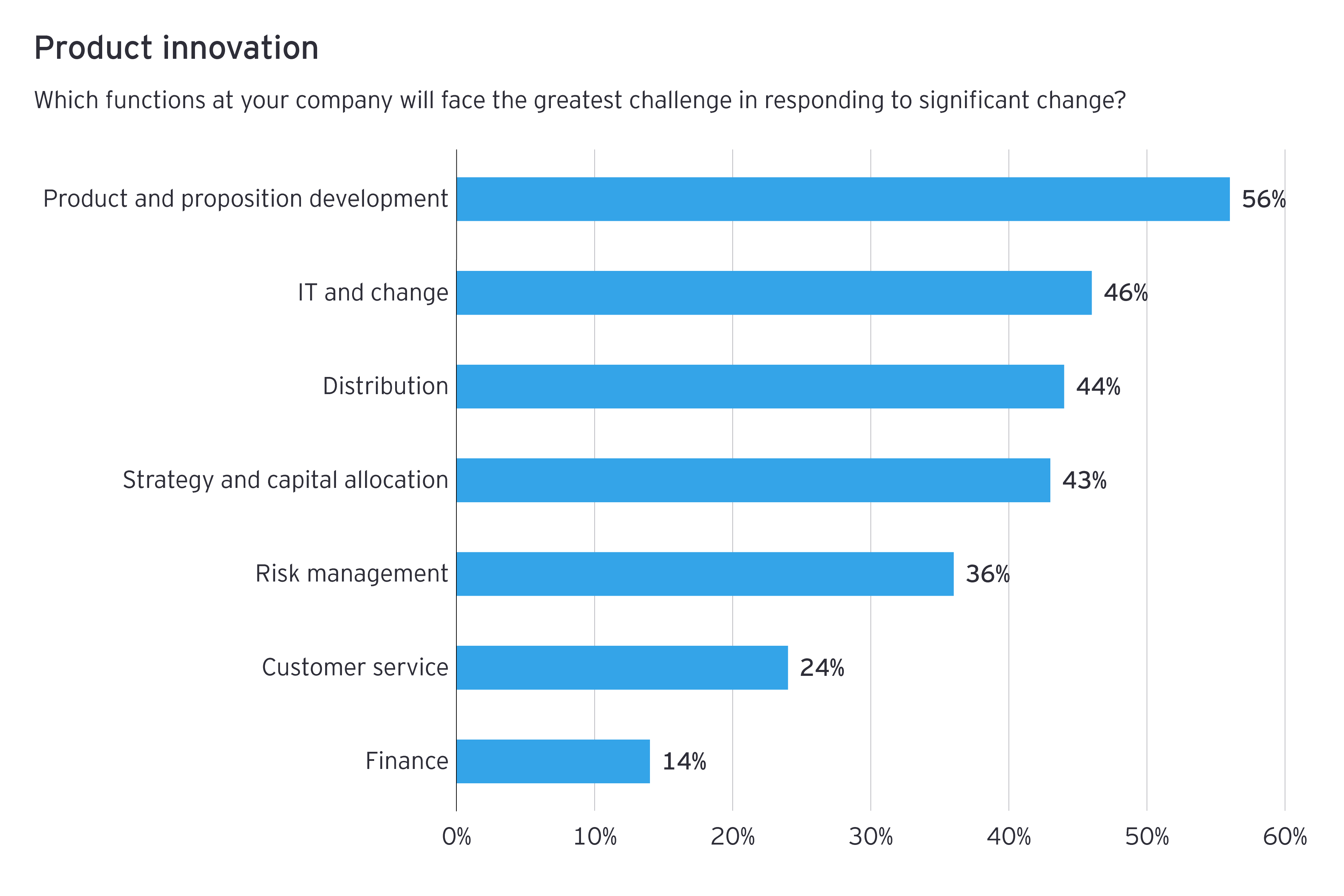

To meet consumers’ evolving concerns and needs, insurers must reimagine their offerings and overall value proposition for both existing and prospective customers. Satisfying this market demand starts with a product innovation strategy built around unique solutions that create differentiation in the market.

However, many executives express concern over the ability to achieve such a strategy. In our December 2020 poll of nearly 100 global C-suite insurance executives conducted during a virtual event, product development was predicted to face the greatest challenge in adapting to change.

Developing leading solutions requires an integrated approach that applies innovation discipline to highly regulated products. It also requires the ability to leverage external ecosystems and collaborate with others outside of the industry. Finally, insurers need an adequate technology architecture and supporting platforms.

But everything relies on first identifying the customer and an unmet need.

See also: 3 Tips for Increasing Customer Engagement

While COVID-19 vaccinations may help address our physical health concerns, the financial distress the pandemic has caused many consumers will be felt for years to come. As consumers’ concerns and needs change, insurers have a responsibility to live their purpose of providing protection to all.

Developing products around new customer behaviors and priorities, and reaching new demographics in need, will help the industry maintain its relevance and play the role it needs to in the recovery.